#11 @Surge_Fi Pre-Thread

New approach on collateral ratio in lending protocol & more (i guess?)

#11 @Surge_Fi

Pre-Thread New approach on collateral ratio in lending protocol & more (i guess?)

They seem to be a new protocol with only an interesting medium post. Discord only opens for a short period of time and FOMO me into reading into it

In this thread

TLDR of what I know about @Surge_Fi so Far

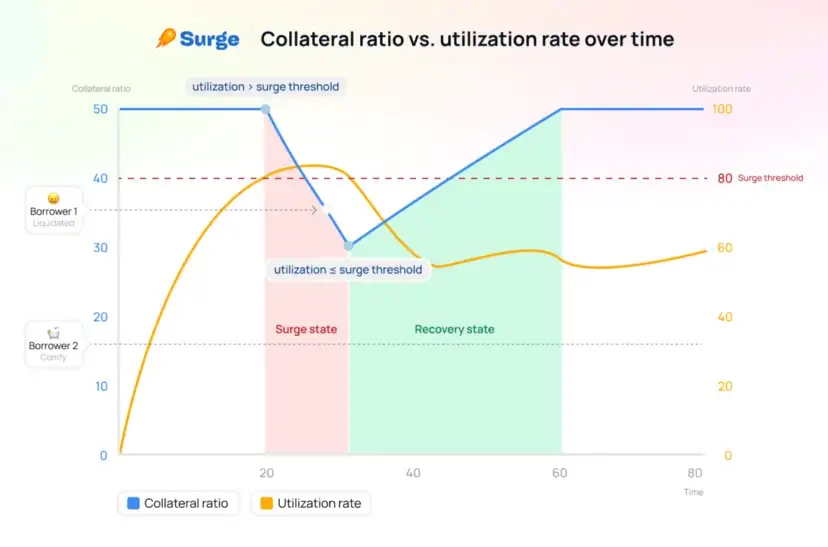

Surge threshold, Algorithmic collateral ratio for liquidation

isolated lending pairs + supply-side aggregation

summary + me trying to get into discord & gitbook

TLDR

I came across a early stage interesting interesting protocol with only a medium.

It allow users to permissionlessly launch lending pools for token with parameters of

loan token

collateral token

collateral ratio

surge parameters

interest rate model

I like new things can’t wait for their gitbook & protocol

To give an overview on lending protocol. Most of the lending protocol uses price feed monitoring the price of ur collateral, and once it drops pass the loan to value threshold you get liquidated.

From what I understanding

SurgeFi seems to want to introduce an “algorithmic collateral ratio” for liquidation. They are introducing a more dynamic approach towards collateral ratio.

As utilisation rate of the loan goes up and hit “Surge threshold”

2. Collateral ratio will fall at a constant rate over time (you can borrow less with the same amount)

If pool collateral ratio falls under borrower’s ratio they get liquidated

Once the utilisation rate of the pool returns to surge threshold (as people get liquidated or add more collateral)

if the utilisation rate never returns back below the surge threshold, the collateral ratio will continue to fall down to 0, liquidating all active borrowers. This ensures that the pool maintains sufficient liquidity to allow suppliers to exit

So why does Surgefi wants to introduce this? I’m guessing because this enables a open market for loans with different tokens to borrow & collateral without the need of oracle and USD.

I personally like the idea of isolated lending pools and peer2peer lending designs like

@eulerfinance and @nftfi

This give a better risk & reward for lender & borrower, lending ETH for a Degen coin and ETH for BTC should not share the same interest rate. Just like in irl mortgage loan rates are always lower than credit card loans.

However these designs typically comes with the same core problem, liquidation fragmentation. Seems like the SurgeFi team is planning to addressing this via Vault and aggregation with limited managerial role.

Summary I like what I see (which is not a lot). I like what I see so far and I fomo to get into their discord & gitbook. @NourHaridy hook a brother up pls.

i like crypto innovation, i don’t like bear market but seems like its a good time for interesting protocols to grow!

Surge_Fi ‘s only online public release piece lol

https://medium.com/surge-fi/introduction-to-surge-protocol-overview-34cc828d7c50