#20 Spice Finance

Want to lend money to NFTs for the High APY

without the stress of management

NO need to take the whole loan & risk alone?

Spice Finance New NFT lending strategy vault gotcha

In this thread

TLDR

How does it work

Why is it useful?

Opportunity and challenges

Summary

TLDR

Spice finance provides vaults for users to deposit ETH/DAI to different NFT lending strategies.

This allows users to have exposure to peer2peer nft loans without having to commit to the full loan amount & stress about the management.

How does it work

To give a brief overview of NFT lending space there are typically 2 type of loans

Peer 2 Peer ( @nftfi @Arcade_xyz @the_x2y2 )

Peer 2 Pool ( @BendDAO , @dropsnft )

Peer2peer

Peer2peer loans have loan amount, loan duration, interest rate. The lender will need to take the full loan size.

Peer 2 pool

has a pool of ETH/DAI and Borrowers will deposit NFT and borrow ETH/DAI based on the pool utilisation rate.

Vault Architecture

Spice finance will have different vaults for users to deposit. Users can choose vaults depending on their risk appetite.

Each Vault has 2parts within them. Base Vaults &lending pools. Base vault is the “NFT Peer2Peer” strategy. It will automatically bid for loans within the set parameters. The idle/reverse of the ETH/DAI within the vault are deposit into other Peer2pool protocol with the best apy.

Why is it useful?

Key points

easier to use, less management

gas optimisation (most nftfi protocol are on eth)

low entry to nftfi and diversified risk

E.g.

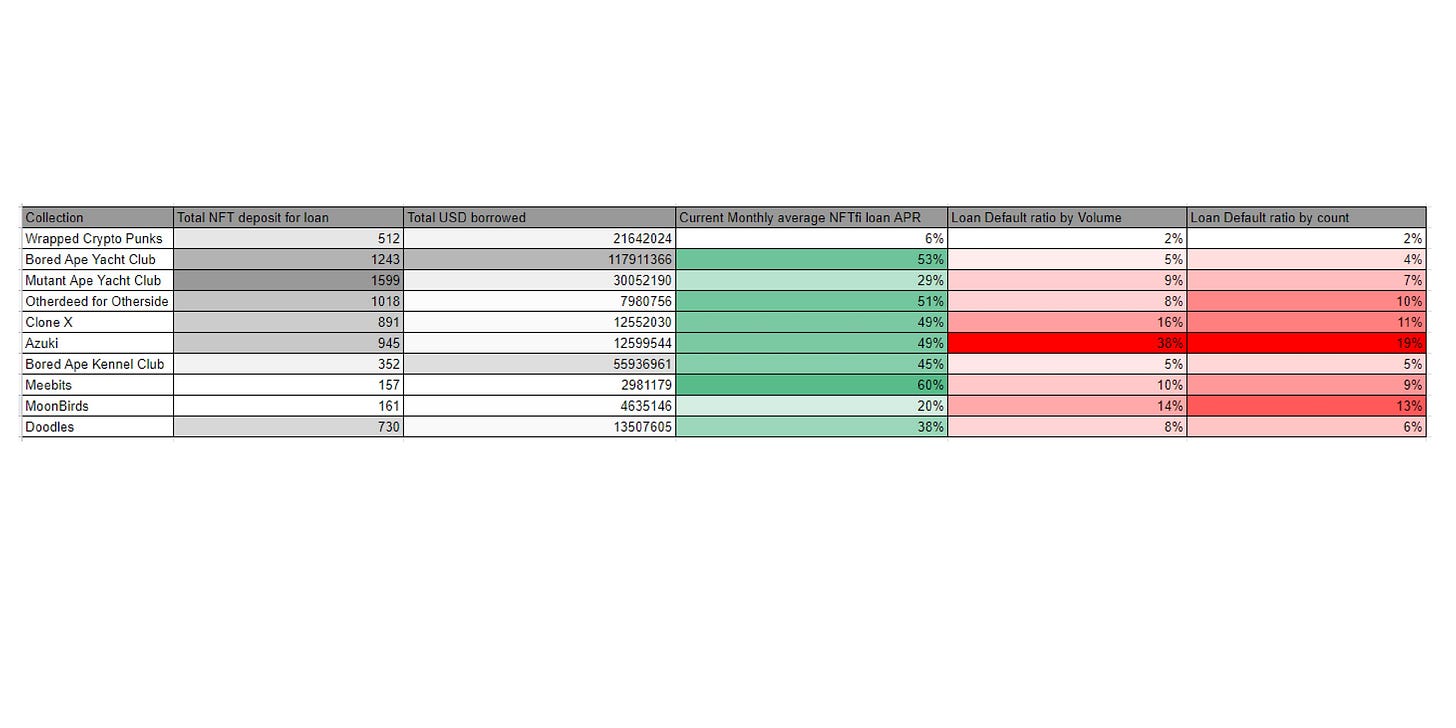

Lending ETH/DAI to NFTs are can have surprisingly high apy return in my previous post although the numbers are old now. Lending to BAYC was at 53% APR monthly average on NFTfi with only 5% loan default ratio ( old data + likely due to $ape staking)

but the point is if i were to take on that loan on nftfi (peer2peer) i would have to supply approx 25+ ETH to 1 BAYC holder, with spice finance i can have similar apy exposure without having taking the whole loan & diverse into different BAYC loan if there were vaults available.

Summary

Spice finance is solving a real problem in NFTfi. I actually wanted to lend money to BAYC and a few other collections on the list from previous NFTfi data tweet.

But i stopped because of i did not want to commit to the full loan and also having the potential to take on the BAYC alone if the nft does drop drastically. It might have a different case if i can just take part of the loan.

Automation & lower entry allows more users try & potential enter the ecosystem. This might be a bit farfetch but will it be the starting point of making NFT more liquid potentially raising the value of NFTs?

I love to see more data on different nft loans and breakdown of vault performance as the vault goes live. Lending is a form of realyield, will spice finance be the first NFTfi real yieldoooor?

P.S i fucking love a meme team, spice team is pretty dope look at the CEO profile @allnattycalves on discord lmao. I love it haha

Thanks for reading!

It has only been around 22 days since i started this, 850 followers on twitter and 38 email subs.

i am learning how to write better content, it’s not the best yet but i hope you found it useful so far. Thank you for being on this journey with me ! see you around anon!