#25 @Contango

New Dex with a cheaper way for you to leverage long/short? Leverage trading with expirables

#25 @Contango_xyz

New Dex with a cheaper way for you to leverage long/short?

Leverage trading with expirables

In this thread

TLDR

How does it work

What does it enable

Opportunities & Challenges

How I would value it, what metrics to look at

Summary

📍TLDR

Contango is a decentralized market for expirables. Contract to buy or sell ETH at a fixed price & date.

Cheaper to leverage trade than perpetual dex/cex (funding rate) but with expiry date.

📍How does it work

Contango leverage @yield, a fixed lending protocol to support its expirable contracts.

It allows traders to open long/short position up to 3.5x with an expiry date.

Here's a flow of position opening&closing

Trader opens a long position

Protocol borrows the quote asset

Protocol sells the borrowed amount for an equivalent amount of the base asset on the spot market to synthesise a long position

The amount of the base asset is lent

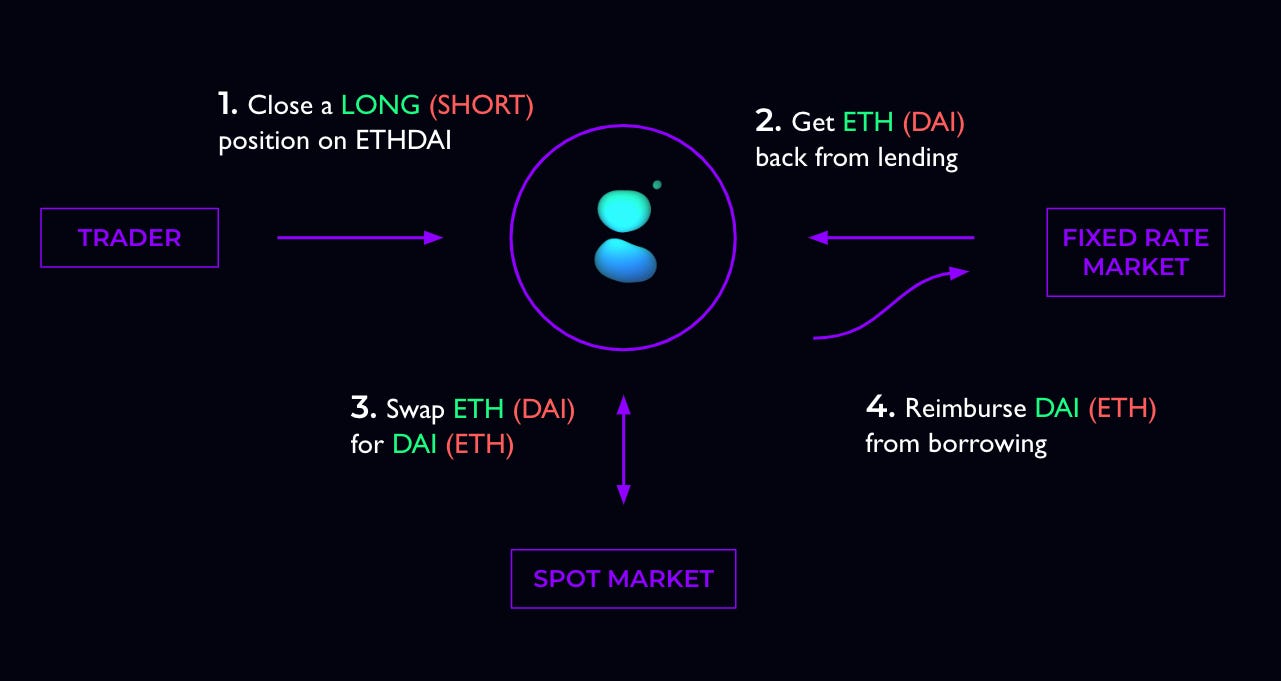

Trader close a long position

Trader closes a long position

Protocol gets the principal and interest from lending the base asset

Protocol swaps the base currency for the quote asset on the spot market

Protocol gives back the borrowed funds including the accrued interest

📍What does it enable

Cheaper way to leverage

More Predictable way to leverage

More dimension to speculate ( time )

📍Cheaper & more predictable fee

Funding rates are actually very expensive and fluctuate.

E.g. BTC is 0.01%, assume the funding rate doesn’t change it will cost you 0.01*3*365 which is around 10% apy per year just to hold the position. Plus at high volatile times it can spike

Where as with contango you are only paying “basis rate” of 0.27% + “basis rate” on closing.

It should be more predictable as the pricing is based on the fixed rate to borrow eth & lend dai. However do need to see how it works in live for longer.

📍More dimension to speculate

As a bad trader that gest liquidated by ftx 247, adding “time” as a dimension will make it even harder for me. But it does give more tools to gud traders to speculate, e.g. they can now leverage trade eth around/post shanghai update in march.

📍Opportunities & Challenges

📍Opportunities

New tool easier to cheaply leverage using lending markets, bringing more trading volume?

Will this drive up the potential yield/market for fixed rate lending?

Alternative model for a new type of perp dex?

📍Challenges

Current model can’t support lots of pairs due to the underlying fixed rate lending protocol

Current model are not able to provide a wide range of time frames.

Potentially a cap on possible open interest due to fixed rate lending (good problem to have tho)

New model of trading can be confusing for retail, UIUX can be improved

Degens might want more leverage (you can’t cater everyone tho)

📍How I would value it, what metrics to look at.

Trading volume, actual n growth

Number of traders

Liquidations

-In relation to other perpetual protocols

Contango dashboard (NOT by @defi_mochi surprising right?)

https://dune.com/contango/contango-arbitrum

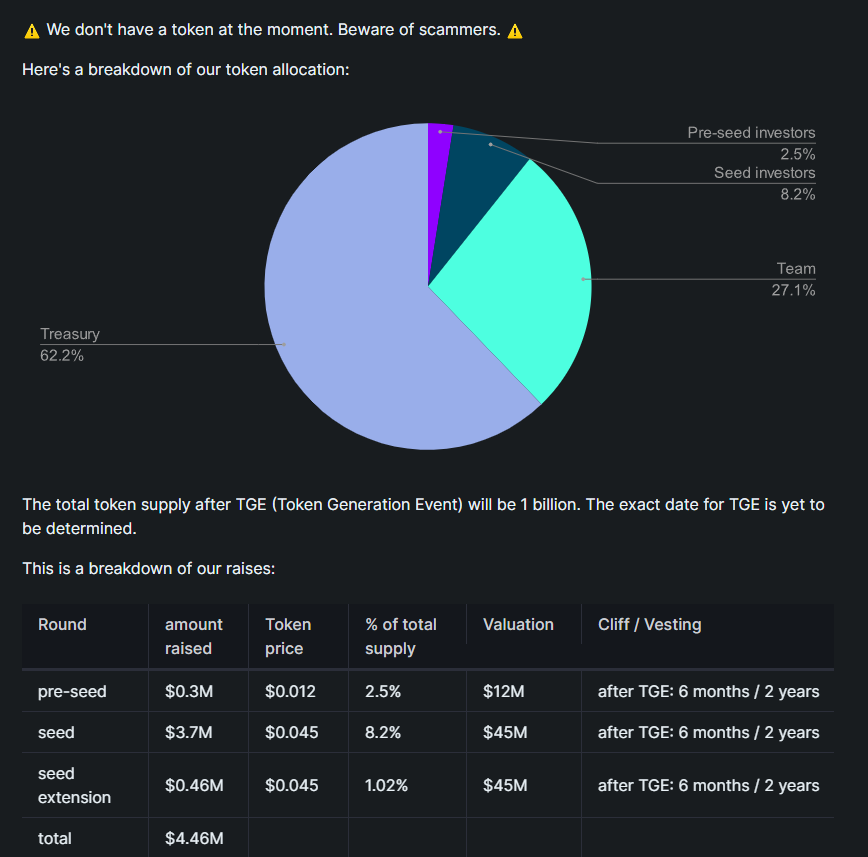

The token utility & emission schedule is not public yet with last round valuation at 45m with 6month cliff is quite high in the current market. Will need to check out their initial mcap to decide next steps.

📍Summary

I like new things. Their investor list is top tier, gitbook well written, total addressable market is big. The core concern I have is how expandable is their structure in offering more time frames/pairs.

However GMX has proven even with limited pairs, when executed well there is enough trading volume to support its valuation. Their tutorials & documents are clear+easy to follow, the next step will be community & improving the UIUX. In conclusion 🐏 like 🐏 keeping an eye on it

Thanks for reading