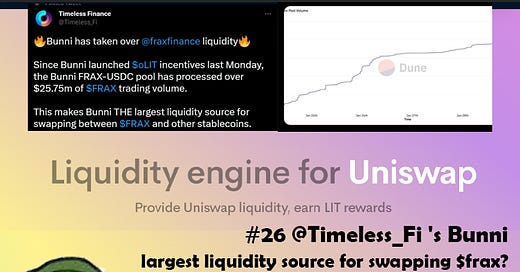

#26 @Timeless_Fi 's Bunni

largest liquidity source for swapping $frax?25.75m trading vol Adding $CRV ve/brible model into uniswap?

#26 @Timeless_Fi 's Bunni,

largest liquidity source for swapping $frax?25.75m trading vol

Adding $CRV ve/brible model into uniswap?

📍In this thread

TLDR of Bunni finance

What is Bunni

How does it add VE into uniswap v3

Opportunties

How would i play it

Summary

📍TLDR

Bunni finance is a uniswap v3 but it’s LP position as erc-20 tokens instead of NFTs. Users can deposit into uniswap v3 via bunni and earn additional reward boosted by vetokenomics.

📍What is Bunni

Bunni aims to maximize liquidity on uniswap v3 and enable other projects to incentivize their token liquidity. Their design was to improve vetokenomics used by protocols.

📍What are the problems of current VE model

Incentive misalignment between LP farmer platform holders, LP will farm and dump without hurting their bags

Cost (emission) to maintain high level of liquidity for platform token

📍Their plan in improving from the typically VE model

Deposit & Lock LIT-ETH LP position to get vetokens, keeping LP and $LIT holder incentive inline

NO veLIT no rewards, keeping everyone have skin in the game

oLIT Call option token as reward token

📍What is oLIT

It is a token that allow users to buy $LIT at a discount

E.g.

LIT is $100, call option token oLIT gives its holder a right to buy LIT at 90% of the market price. The protocol issues 1 oLIT to a farmer lambro, who immediately exercises the option to buy 1 LIT for $90 and sell it on a DEX for $100. The tally of gains & losses are as follows:

The protocol: -1 LIT, +$90

The farmer Alice: +$10

The DEX LPs: +1 LIT, -$100

Compare this to regular liquidity mining where the farmer doesn’t pay anything to the protocol:

The protocol: -1 LIT

The farmer Alice: +$100

The DEX LPs: +1 LIT, -$100

📍How does it add VE into uniswap

User create LP on uniswap via Bunni

Provide LIT/ETH to get veLIT for the yield boost

Gets additional emission reward compare just on uniswap

Users get oLIT

User can convert oLIT to LIT and sell for yield or continue to boost its ve

📍Opportunities

Brible market coming soon.

The total veLIT increased around 70% since yesterday

Will it be the next @redactedcartel @StakeDAOHQ ?

📍How I would play it

Early boosting, boosting is based on the ratio of ur ve & deposit ratio compare to the pool. Being early means its cheaper for u to boost your ve for higher yield boost at a lower cost. However my friend who spotted this @ViNc2453 and i suspect that total lock will grow quite fast.

📍Here’s a few ways to play this

Degen Chad

Buy LIT get max VE as much as possible to boost your yield, get it as early as possible and stack before everyone. You will need to make sure the yield covers your cost.

Reasonable pepe farmer

Get a little of LIT and farm and compound your ve power for yield boosting

Strongly suggestion you don’t buy and hold LIT as emission is inflationary

Essentially VE are mainly PvP farming games, being early and estimate on how people will follow and take part in the bribing market when it comes out.

📍Summary

Essentially Bunni is a CRV model with a small twist. I am interested to see how this PvP yield game is going to turnout with the new dynamics introduced by the team such as LP for ve & oLIT.

I do have to say their lack of docs & $LIT token is part of timeless finance somehow can be a bit confusing and annoying to pick up but I have a gut feeling it might be early alpha.

CRV ve models is not my specialised area. I probably need to pick my fren @defi_cheeta ‘s brain on this.

( yes i have farm engagement so much he has become my fren )

Thank you @ViNc2453 to sharing this alpha with me + sharing his insight

📍Follow up material

Somethings i am not clear about bunni on

is this math behlind yield boost ?

let your veLIT = v

let total veLIT = V

let you deposit in pool X = d

let total deposit in pool X = D

boost ratio = max(100%, (v/V) / (d/D) )

is oLIT to LIT price dynamic?

Thanks for reading

@Timeless_Fi feel free to correct me if i got anything wrong.

Sources:

Bunni data: https://dune.com/bored_genius/bunni https://bunni.pro

https://blog.timelessfi.com/