#34 @MorphoLabs

Bringing Peer-to-Peer APY & lending capital efficiency to @aaveaave @compoundfinance

📍In this🧵

Morpho TLDR

What & How does Morpho works

Protocol metrics

🐑Lambroz’s speculation

How 🐑Lambroz would play this

Summary

📍TLDR

@Morpholabs is a Peer-to-Peer layer on top of peer-to-pool lending protocols. It improves rate for both lender & borrower by reducing spread of borrowing it’s peer 2 peer model.

📍What & How does Morpho works

Morpho is a peer-2-peer layer built on top of aave & compound. Users interact with Morpho the same way they use aave/compound with the same amount of borrow & lending capitacty and collateral factors, oracle, close factors.

The only difference is by depositing into morpho instead of aave/compound directly, user's deposits are not on Morpho’s Peer-to-Peer Matching Engine, and moving their borrow/lending from a peer to pool into peer to peer, improving the rates for both sides

📍To expand on above i will go over

🔹What is peer-to-pool & peer-2-peer lending

🔹Advantages & Disadvantages of different model

🔹How does Morpho improve rates?

📍Peer-to-pool model

🔹What is peer-to-pool & peer-2-peer lending

Basically its Lenders (Bob) putting money into the pool (aave) and alice borrows from the pool.

It’s apy to lenders (bob & his other peers) are based on the utilisation rate of the Pool.

Utilisation rate meaning how much is borrowers (alice & her peers) borrowing in the ratio of the pool as alice will only pay for the interest she is borrowing

utilisation= % of the pool is used.

Without getting into too technical, you can imagine if there is 100 usd in the Pool but alice only borrowed 50 dollars, that means technically Bob and his friends are only getting 50 dollars worth of interest rate as apy. Hence low capital efficiency.

🔹Advantages of peer-to-pool model

Instant liquidity, Alice can borrow money anytime as bob pre deposit the money in the pool already

Deposit and forget, Bob is rich he can just put some eth there and earn from lending fee passively with little management

🔹Disadvantage of peer-to-pool model

Capital inefficiency, a lot of rich bob’s money is just sitting in the pool waiting for alice to borrow more

APY spread, Difference of between lending & borrowing rate because the borrowing fee is spread across the whole lending pool

📍Peer-to-Peer Model

TLDR, Lender(Bob) will have to create smart contracts and wait for borrower (Alice) to match it. As you can imagine, Bob will need to set time, amount, interest rate, collateral etc.

its annoying and rich bob aint got no time for that. These matching fraction reduce the use of peer-to-peer loans

🔹Advantages of peer-to-peer model

Capital efficiency

If Bob sets a lending contact of 50USD and matched, 100% of the money is lended out to alice, getting 100% of the fee

Flexible of terms

essentially its an agree between two people, if Bob is a simp he can just take some selfies from Alice as collateral if Alice is as hot as @Irenezhao_

🔹Disadvantage of Peer-to-peer model

It has to be fix term loan

if borrowed asset’s price is too volatile and drop over the amount borrowed, Alice might kee the 50USD and let Bob keeps the selfie (bad debt)

borrower & lender matching difficulty & time

📍How does Morpho improve rates?

Simply put. Morpho is a mix of both. Morpho puts lenders in the aave/compound pool when there is no matching and helps users auto peer to peer for a better rate when it's possible.

🔹Advantage of Morpho

Instant liquidity as unmatched peer2peer loans to routed to aave/compound

The lender is matched peer-to-peer more better rates

More Capital efficient when matched

Same liquidation parameters as aave/compound even when matched peer-to-peer thanks to Morpho’s set of liquidators.

🔹Disadvantage

Additional smart contract risk

Less rate flexibility compare to Peer-to-peer

📍Protocol metrics

🔹P2P matched 223m quite impressive

🔹1.21m fees in 30days !? might be a error on @tokenterminal as morpholabs team mention its not enabled yet

🔹Morpho’s fee structure will be based on cut of improved p2p apy

📍🐑Lambro’s speculation

🔹relatively high tvl already

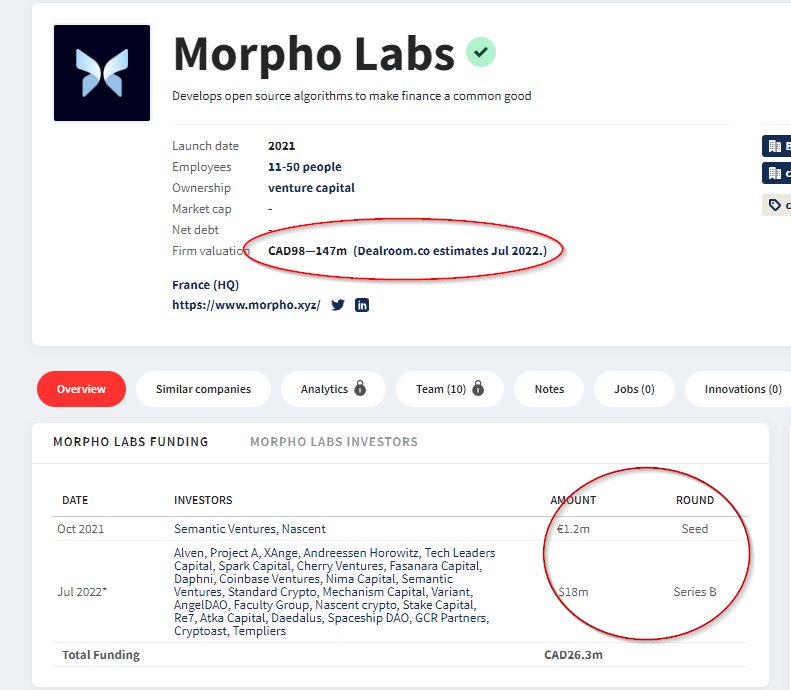

🔹raised 18m from top tier investors at approx 110m valuation

🔹although tokenomics is not out yet but valuation around 110m and 1b number of token. I think it's will do a very rough speculation of each token prob at 0.11

🔹0.11 per token (bull market raised valuation, potential down round in future, info of valuation might be wrong, valuation might include equity, listing price of token typically are higher than private)

📍How 🐑Lambroz would play this

I think the right play is if you have some idle money sitting in aave/compound and not worry about the additional smart contract risk you should put it there.

0.11 is a very rough estimation of the base price for apy. It heavily depends on initial mcap on TGE, how will the $morpho reward be distributed etc with the right conditions (rough guess)

In conclusion if you are farming on aave/comp, why not at farm for a better rate and potential pumpable token from a protocol that has real use + tier 1 investors?

📍Summary

$Morpho truly improves the lending without requiring the user to do more work, it is a real tool that actually works. I look forward to seeing how much fee they can collect as a protocol and more detailed tokenomics in a later stage.

Their gitbook is very well written, they are good at communicating complicated concepts to the general public. Always bullish on dev teams that can talk to the general public.

More details on Matching engine with examples of different cases

https://medium.com/morpho-labs/the-secret-to-better-apys-meet-morphos-matching-engine-d071abe00a05

Peer-to-Pool explained

https://medium.com/morpho-labs/lending-pools-an-imperfect-breakthrough-357962c34364

Peer-to-Peer explained

https://medium.com/morpho-labs/peer-to-peer-lending-too-early-to-work-the-ethlend-case-6b50e1234ec6

Morpho model overview

https://medium.com/morpho-labs/morpho-the-best-of-two-worlds-1d8b641b8393

Thanks for reading guys