In this thread

1)TLDR

2) How does the protocol work

3) Why is it different

4) Potential

5) Key details to be aware of

6) Overview

TLDR It is a Perpetual Dex that allows you

-Trade #Crypto, #Forex, #NFT & Indices Markets up to 100x Leverage

-Liquidity Providing without Impermanent loss

*This is not a #GMX fork hence why I'm interested/ looking into it

How does the protocol work

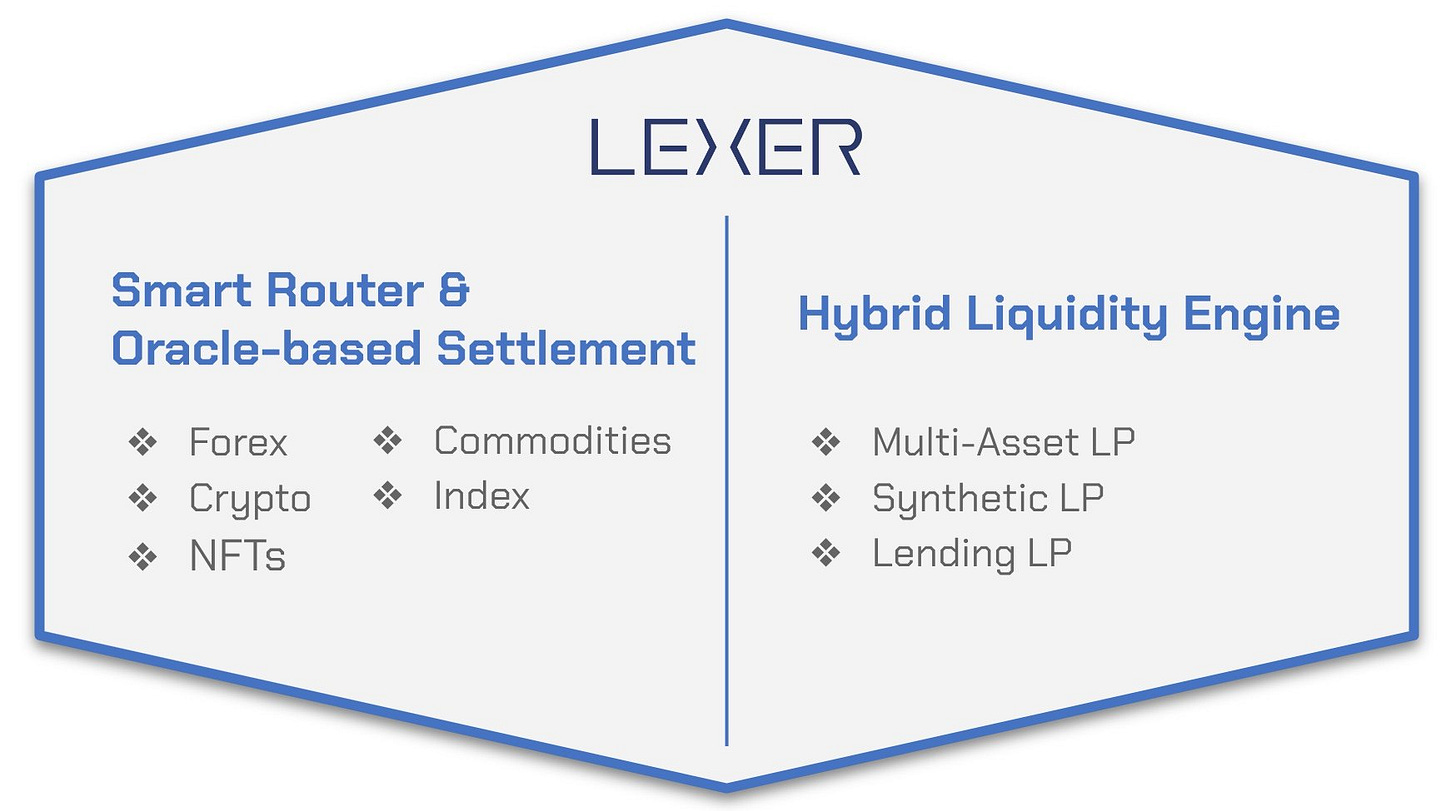

Lexer has two core components

“ Smart Router” & “Hybrid Liquidity Engine”

Hybrid Liquidity Engine includes

-Multi-Asset LP ( @GMX_IO style LPs )

-Synthetic LP ( @GainsNetwork_io style)

-Lending LP ( @OpenLeverage style) this enables any assets to be traded through “ Smart Router “

Lexer aims to be “Perpetual everything” in a decentralised way.

Potential

Cross margin, Lexer’s position as NFTs enabling cross margin

Although I don’t fully understand how they are achieving this as its not live yet but as a trader, being able to cross margin decentralise will greatly improve capital efficiency

*if you are a gud trader kek

Keys details for any Perps

1) Oracle, How does it work? is it safu?

2) Risk Control

3) Tokenomics

Oracle

TLDR Lexer using on-demand decentralise oracle network (DON),

-takes median spot price of leading exchanges

-keeper mechanics to keep stability & credibility of the price feed by constantly comparing to @chainlink oracle price

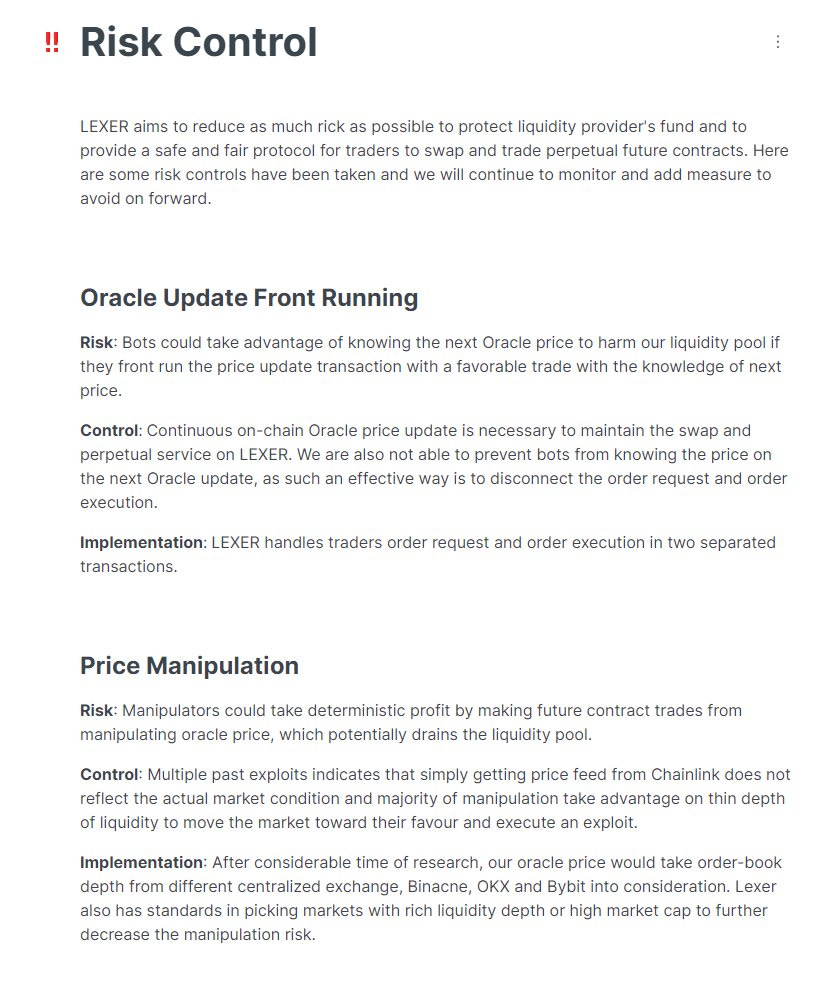

Risk Control

Their gitbook did cover two key risk of a Perp, oracle update front running & price manipulation but it will be good to see an insurance fund setup.

Tokenomics

Seem yet to be confirm but the design is following the #GMX which is 70/30 % to LP and LEX staker

Overview Lexer is a breath of fresh air compared to other gmx forks. They are dreaming big to enable perpetuating everything with their “Hybrid Liquidity Engine”.

Product wise i think they are on a right track but all perpetual’s KPI is driving traders & trading volume, it will be interesting to see how goes