In this thread

1. TLDR

2. Traction so far

3. How the protocol works

4. vAMM & funding rate

5. Summary

TLDR

@nftperp lets you perpetual long or short @BoredApeYC@AzukiOfficial, Milady, MAYC and @cryptopunksnfts up to 10x.

Traction so far

Thanks for @0x_aster Dune dashboard, you can see all key stats, 24k #ETH in volume and over 10k trades

How the protocol works

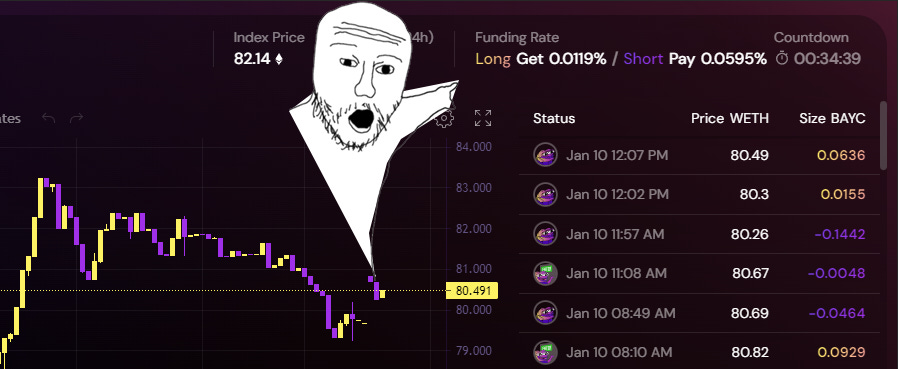

NFTperp has two price

“Index price” can reference it as true floor price of the #NFT

“Spot price” can reference it as the virtual perpetual price based on market demand & supply

Traders can go long or short on perpetual price, their profit will be based on their exit perpetual price.

Index price is an aggregated price feed from on/off chain.

The index price & spot price are kept correlated via funding rate.

vAMM

vAMM allows nftperp to have a model that is trader vs trader. It does not require a liquidity pool. It uses the same x*y=k constant product formula as uniswap.

The benefits of it allow nftperp to have a smooth trading experience without the need of liquidity.

But ser how does index price keep correlated with spot price?

- funding rate NFTperp balances out long/short ratio keep the two price correlated via their dynamic funding rate.

TLDR, If there is a lot more “Long” then people who are holding long positions have to pay the short position the funding rate %. The difference of Perp & index price are also taken into account

Summary

Nftperp uses a similar model as @perpprotocol. This enable a new way for NFT degens to speculate the price. Although vAMM is not perfect such as to its slippage in size and its small risk of short term depeg in index & spot price.

This is an interesting protocol that allows users to short for hedging their NFTs in bear market, leverage speculate price without buying the whole NFT. It will be interesting to see what other features they are building on this protocol.

Further readings on vAMMs, Orcales, funding rates

https://qmeasuregrey.medium.com/on-vamms-unnecessity-for-a-liquidity-pool-6662751f3acb

https://nftperp.notion.site/NFT-Price-Oracle-bbd35a9af5c34361ab4b0c692e736596

https://nftperp.notion.site/Technical-Stuff-8e4cb30f08b94aa2a576097a5008df24