new perpetual exchange public beta launching 18th January In this

Thread

1) TLDR

2) How does the protocol works

3) Providing Liquidity

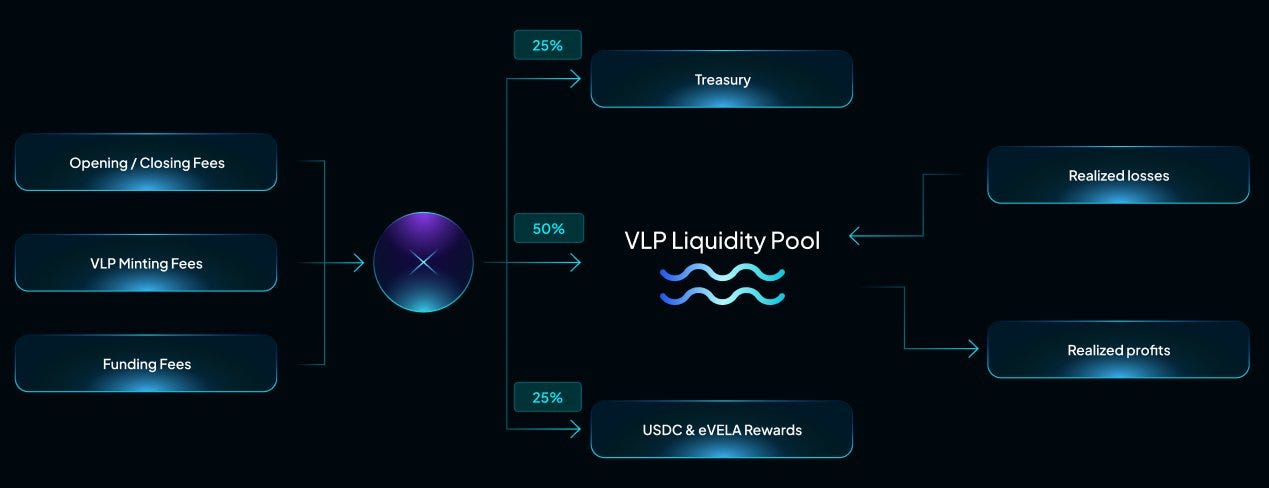

4) Fee sharing model

5) $VELA & $eVELAToken Utility

6) Hyper $VLP rewards

7) Summary

TLDR

Vela Exchange is a decentralised perpetual exchange offering

crypto,

forex

market capitalization. ( yes, you can soon speculate the $USDC mcap )

How does the protocol work

Trader Point of view Trade about asset Crypto

- #BTC, #ETH, #DOGE leverage up to 30x Forex

- $EUR, $GBP, $JPY up to 100x Market Cap

- USDC Mcap up to 30x (soon) Also allows limit, stop market , stop limit, take profit/ stop loss, Trailing stop order

Liquidity Provider Point of view

$VLP is the liquidity provider token for vela exchange platform. It is a $USDC based staking and it can be redeemed for USDC anytime after 3 days of cooldown from mint.

Stake $USDC to mint $VLP to earn vela fees + PnL of traders.

When trader lose money, you $VLP gain LPer can also stake the $VLP to earn extra amount in $eVELA

Do note although vela model is similar to gns model but their $VLP is almost like a vault token changes in price due to that gain/lose net flow of USDC based on fees + trader PnL.

$VELA & $eVELA can be staked to earn % of fees as rewards.

1.VELA/eVELA benefits Receive discounted trading fees as per the fee discount table 2.Earn eVELA from each VELA buyback equivalent to 10% of the total perpetual fees 3.Earn 5% of the total fees in USDC generated by the perpetual exchange fees

4.Earn 40% of the total fees generated by the spot exchange fees (Future)

5.Earn eVELA from each VELA buyback equivalent to 30% of the total spot fees (Future)

6.Earn 30% of the fee share of the OTC trading platform (Future)

7.Earn ecosystem rewards (depends on chain and subject to change) $VELA has a 72 hours cooldown to unstake $eVELA can be deposit into vesting contract to unstake throught our a 1 year linear vesting period.

Hyper $VLP rewards

This is the liquidity bootstrapping event for vela.

• A total supply of up to 2.5 million $VELA tokens will be rewarded through this program

• Early minters get higher rewards through the tiered system shown below

• Once a tier is filled, the next tier opens

• Minters cannot redeem their VLP for USDC until February 1, 2023

• After the two weeks, Hyper VLP participants may qualify for monthly rewards for a 1 year period until they redeem

• Redeeming VLP value below the threshold committed during the 12-month distribution period will result in rewards decreases approximately proportional to the amount originally committed

• Hyper VLP rewards forfeited from redemptions will be distributed among all qualifying participants left in a tier Find out more here

Summary

Vela is a perpetual exchange with a twist on tradable markets with market traction. They start doing their marketing since Sep and their community is quite vibrant.

The team seems solid and have shown they are true builder from pivoting from a OTC swap.

What caught my eye was enabling trading mcap of USDC, although technically you can enable almost any asset with synthetic LP engine.

It will be interesting to see how they handle risk management and bring in more interesting pairs and how much trading volume they can bring to the vela platform