In this thread

1. TLDR

2. How does the protocol works

3. Trading & farming opportunity

4. Interesting views on yield right now

5. Summary

It allows user to tokenize & trade future yield

Pendle finance locks yield-bearing tokens into Princple Token (PT) and Yield Token (YT).

PT & YT can be traded via a custom V2 AMM. PT can be claimed upon mature date and YT can be claimed anytime

How does the protocol work

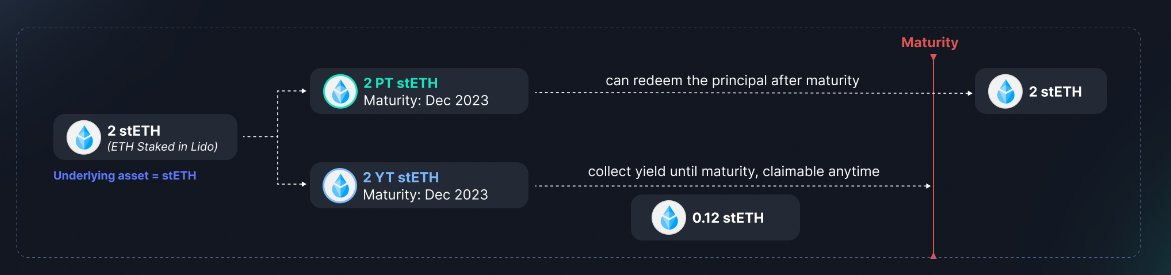

Using #stETH to explain

1. 2stETH staked in Lido.

2. Tokenised 2stETH into “2PTstETH” & “2YTstETH”

3. Redeem your 2stETH upon maturity date, or sell it on the market at a discount for liquidity

4. Claim your YT anytime, or sell the YT for liquidity

Here is more example for reference

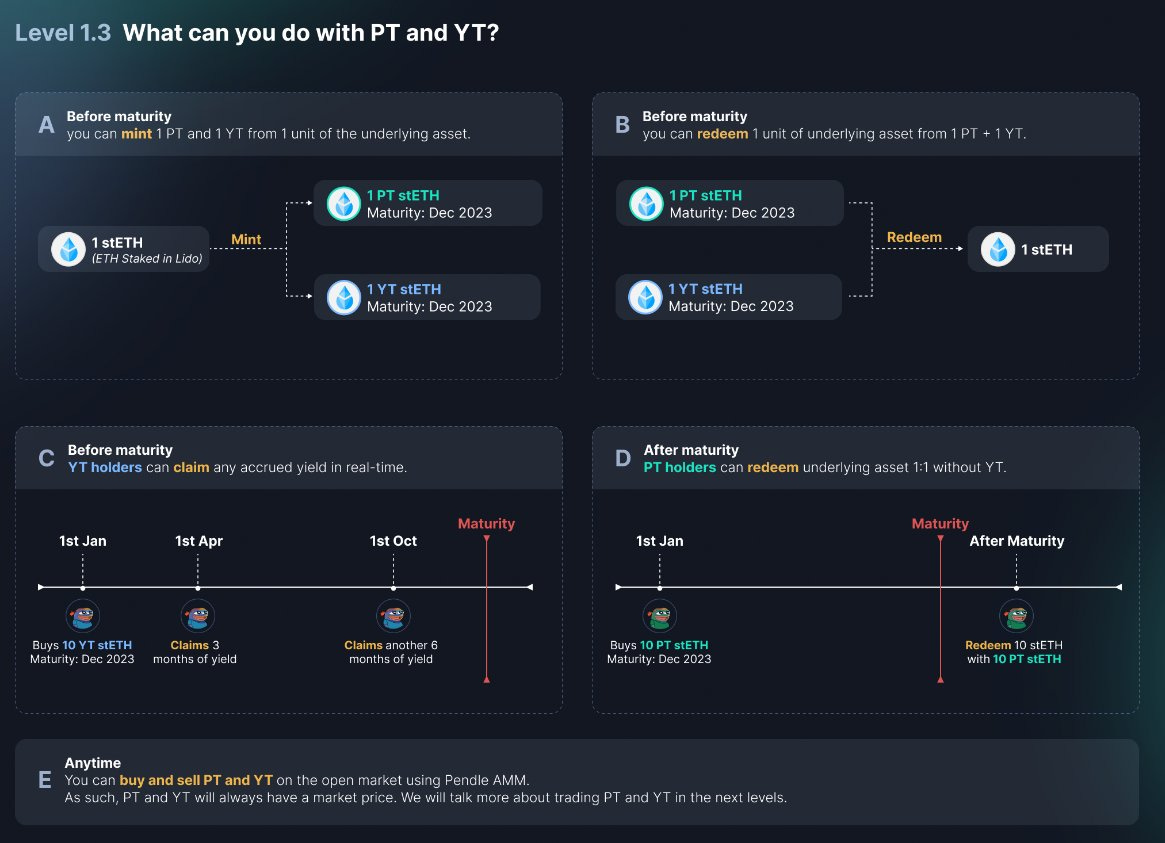

Before maturity you can

1. Mint 1PT & 1YT from 1 unit of the underlying asset

2. Redeem 1 unit of underlying asset from 1PT +1YT

3. Claim any accrued yield in real-time (likely a discount as you are pulling out early)

After maturity

- PT holders can redeem underlying asset 1:1 without YT

Anytime

- You can also trade PT & YT on the open market.

Farming opportunity

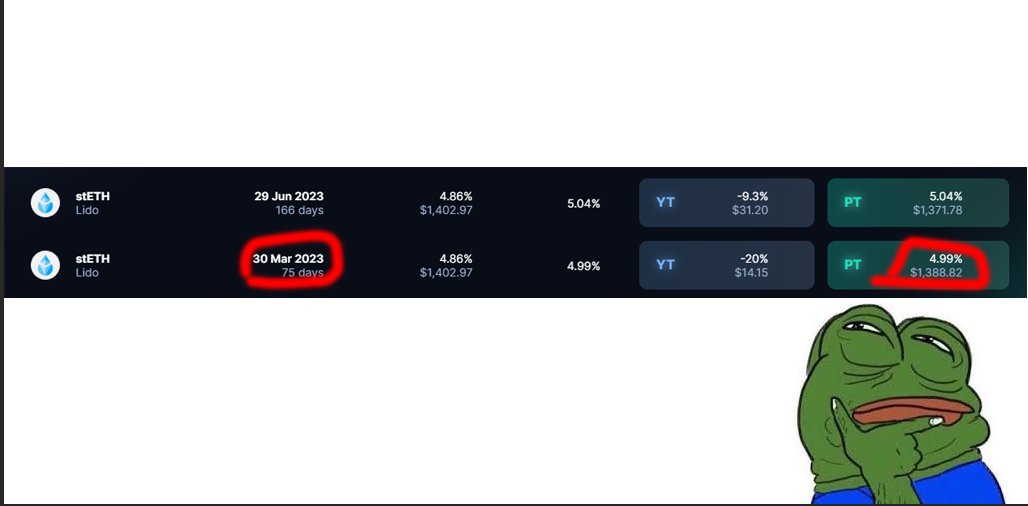

1. Buy PT at a discount and redeem upon mature date *do note this means you are betting on in X days later, the token will be greater than that price.

E.g. if you think stETH will be >1388 in 75days it is a good buy.

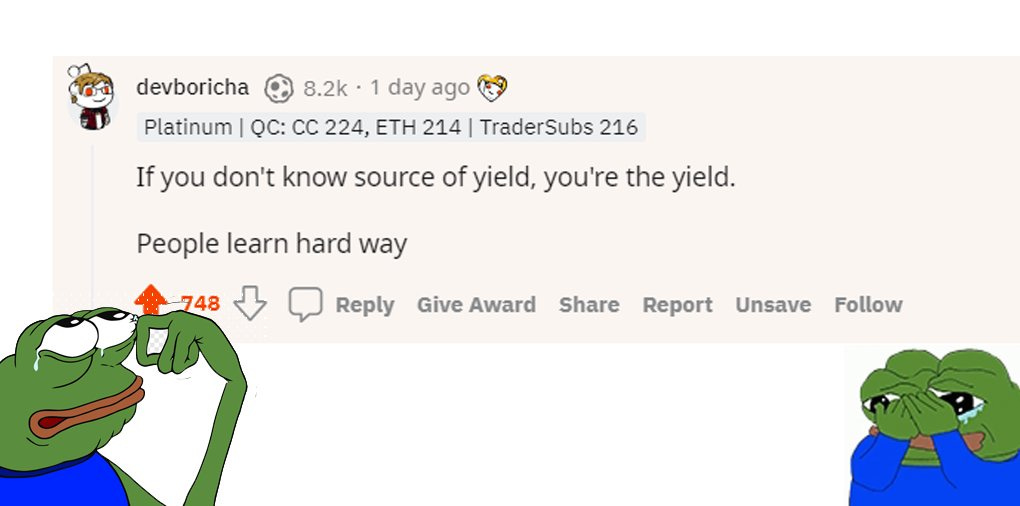

For these type of strategy you should stay aware where the yield coming from is from token inflation or fees etc.

e.g. check $ape pool on pendle

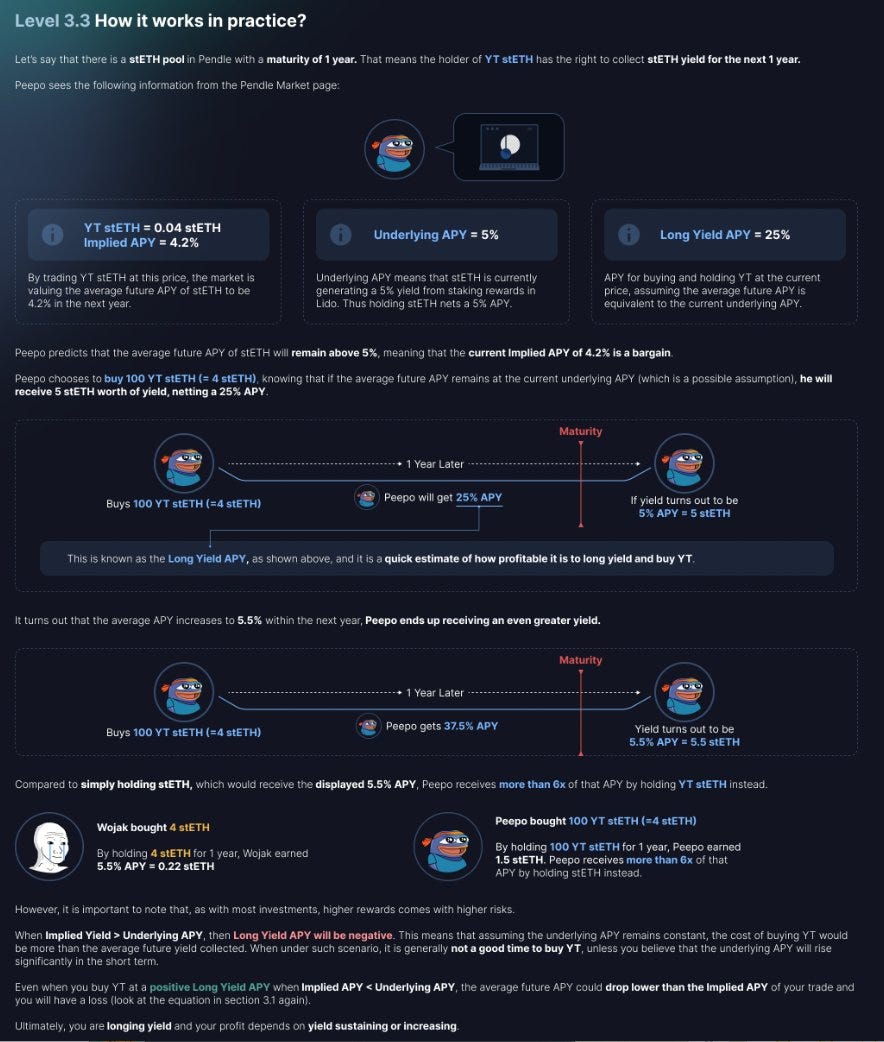

2 Long yield.

As YT can be redeem anytime, its likely bearish people will redeem their yield earlier and as its closer to the mature date there are likely to be more yield in the end.

*do note that actual yield will be based on underlying yield + incentive yield + how much yield was redeem.

You can potential earn a lot more to hold out YT as everyone decides to redeem early. You might potentially earn less yield because of the underlying yield source being unsustainable.

Interesting views on yield right now

Both #stETH is in negative long yield apy, meaning implied Yield>underlying apy. This is likely because of the speculation on shanghai upgrade for #eth.

No surprise in $ape YT in a great discount, as its yield is coming from high inflation.

Might be interesting to keep an eye on looks. pool

Summary

I think pendle has one of the best UXUI dapp experience i ever encountered with very good educational materials, making this thread almost self made.

I started looking into pendle as one of potential strategy on stETH however looks like traders there are ahead of me already haha. Turned to see can I short $APE on perp to do a DN strategy somehow but the funding rates were too high.

The yield in DeFi right now is very low & limited, however given the team’s execution on UIUX and constantly delivering (its a relatively old dapp). Pendle is definitely something I keep an eye on as DeFi yield picks up.