MAV pumped BNB, will MAV pump?

latest BNB Launchpad Project - @mavprotocol

high valuation low "real" circlaring supply" ?

📍This thread

What is Mav protocol?

Tokenomics

Metrics & Valuation

3 Action plan for 3 thinking mode

Summary

There is a track record of BNB pumping whenever there is a launchpad project.

and it seems to be this case as well.

if u want to know

I DO HOLD BNB

I bought very little in this dip

I do believe BNB will at least have a small pump exit window

I DO NOT recommend u follow this buy

Skip to the last few tweets in this thread if u just want a summary

suggest read

4️⃣Action plan

5️⃣ Summary

1️⃣ What is Mav protocol?

It a simple term, it is a swap with a special algorithm providing efficient liquidity.

Liquidity providers also has more option in different ways to provide liquidity with different exposure.

Founded by @alvinxuzj

raised 17m from @PanteraCapital & more

🔹 Deeper look into Mav protocol

It is launched on ETH & zkSync on March 2023

Their "Maverick AMM" benefits "LPer" & "Trader" by having a efficient LP model.

Lets take a deeper look at it's LP model

Maverick AMM introduce the concept of directional LP.

In short it provide more control/option for liquidity provider.

They have 4 type

➡️ Mode Right

⬅️ Mode Left

↔️ Mode Both

⏹️ Mode Static

If u want me to explain in depth DM me.

High level speakingProvide

➡️ in "Mode Right"

- As LP u think the LP token is going up, willing to buy any price

dca up + fee

⬅️ in "Mode Left"

-if u think the price will down, willing to sell at any price.

almost like dca down + fee

↔️ in "Mode Both"

Ur view is that fee is high enough to cover IL & small change of delta and low volatility.

⏹️ in "Static"

Yo basically @traderjoe_xyz liquidity book

i haven't testing providing LP here yet, but this is what i think the outcome is for providing these mode

From what i understand i worry as LP I will lose in delta n IL a lot.

But might need to test things out to understand more.

likely more of a tool to buy or sell + earn some fee on the way

like uniswap v3 but anyways i will keep u guys update.

Good efficient liquidity leads to less slipperage, better price for traders, more trading volume. better for the dex

But does tokenomics capture value?

Lets look into tokenomics

2️⃣Tokenomics

$MAV token can stake to receive veMAV, used to vote for protocol governance, ( not uniswap type of hopium gov tokens )

veMAV will provide voting right including allocating protocol incentives to pools within maverick. ( Maybe some brible ?)

However its not on UI

I think its unsure how much protocol value does $MAV capture right now.

it's also weird that i can't really find info on their tokenomics on their site or online but only on binance research.

when questioned in their discord i got this response

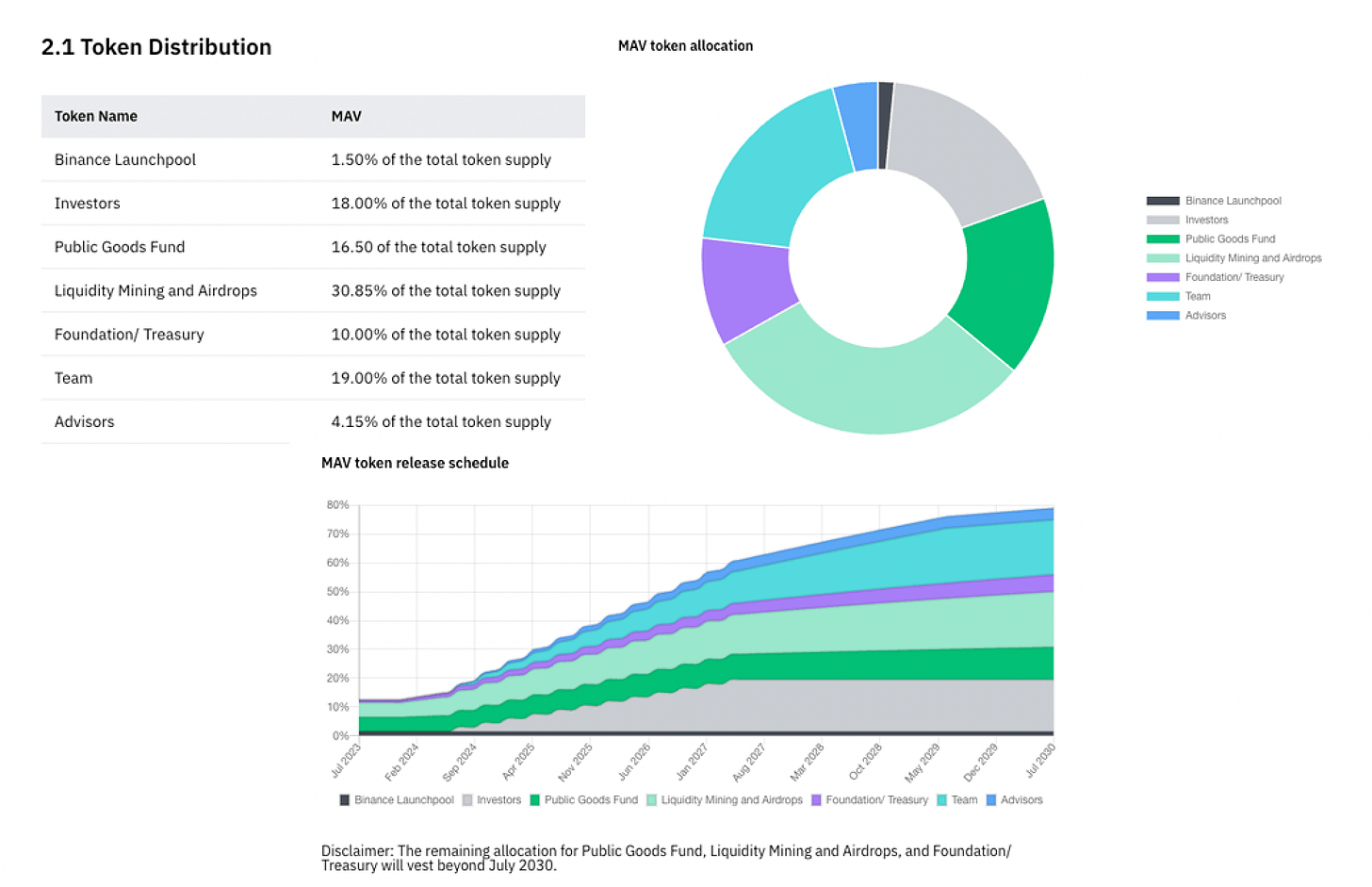

🔹Token Distribution

binance launchpool 1.5% (no vesting)

Investors 18% (starts unlock Jun2024)

Public good 16.5% (5% TGE, unlock starts Dec2023)

Liquidity mining & airdrop 30.85% (5% TGE, unlock starts Dec2023)

Foundation 10% (1% TGE, unlock starts Dec2023)

Team 19% (0% TGE, unlock starts Jun 24)

Advisor 4.15% (0% TGE, unlock starts Jun 24)

Initial circ supply: 12.5% of total supply

Valuation from binance research.

0.1 $MAV !? = 200m FDV !? 🤯

initial mcap = 25m !? 🤯

bro are we back in bullmarket? why m i still broke

3️⃣ Protocol Metric

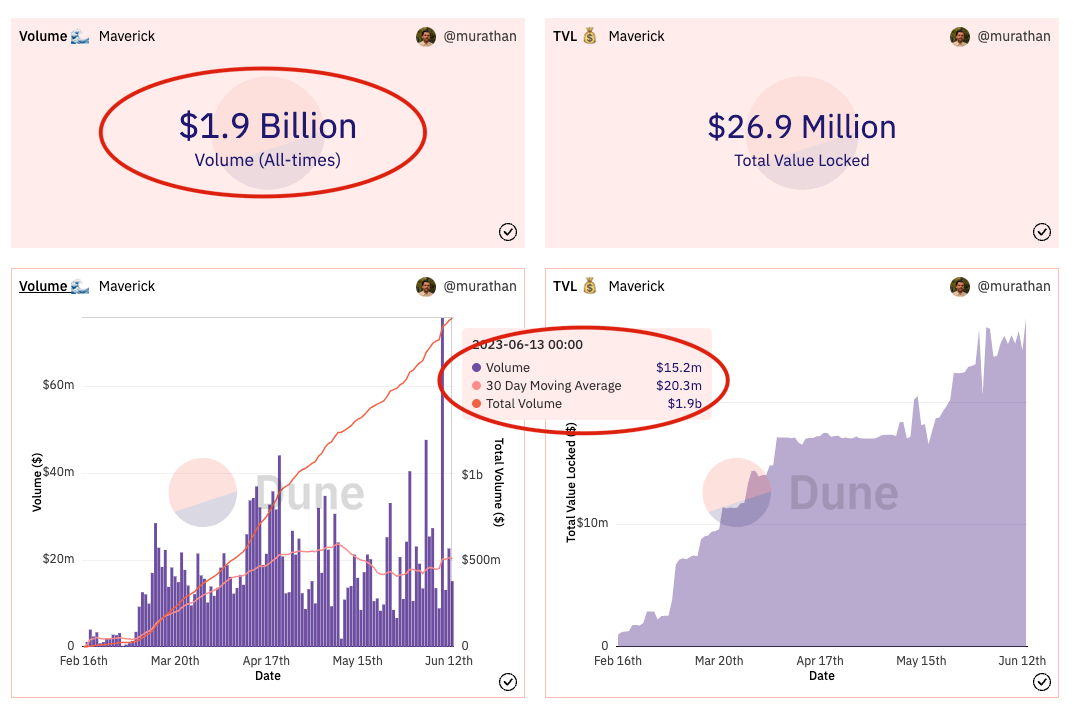

Great dune by @0xMurathan (n he follows me🫣)

Summary

In 4months time

Great growth in trading Liquid Staking Tokens ( trading vol likely pool efficiency) 25.3% trading vol of LST market share

1.9b total trading vol in 4months

26.9m TVL

Full transparency i did NOT check all the stats and i just free ride @0xMurathan work on dune

great respect to all dune wizards, check out his profile please

📍Marketing

@mavprotocol go-to-market strategy & marketing was done on point

incentivizing airdrop hunters to LP & Trade

Went on zkSync at the prefect time where trading volume, hype & airdrop hunters were at their peak.

Able to get push TVL to 6m in 10days of launching

the TVL jumped from 800k in 7th Mar to 6m in 9th Mar, might be data glitch or the team were able to get some liquidity investment from investor or ran some good campaign i missed.

Either way it should team's excution ability

4️⃣ Action Plan

I will breakdown a few actionable with my logic

BNB launchpad farm n dump

Buy with Hopium n believe in CZ

Sit out because its bear market, but farm that $MAV hard

1️⃣ BNB launchpad farm n dump

If u hold BNB, do launchpad

1.8b worth of bnb farming already.

but free is free, like a buffet just eat as much as possible

If u are holding BNB, in CEX or Chain or not if anything happens BNB will drop like FTT so just deposit CEX n farm

2️⃣ Buy with Hopium n believe in CZ

in short, CZ gud, token will pump because binance need to show strength

Also initial mcap is actually basically all controlled by team

public good 5%

airdrop 5%

treasury 1%

they don't have to give out all tokens in airdrop or just add some vesting to it.

if they really want to they can keep the "real" initial supply at 2-3%

which is just around 4-6m real circlaring supply which is very "pumpable" for a token listed on binance.

HIGHLY SPECULATIVE

3️⃣Sit out because its bear market, but farm that $MAV hard

Be a bear market puss like me.

u guys have fun, i will just farm n hold/sell depending on my mood.

i hv low risk exposure & money because of ftx,

enjoy some upside of the token without too much risk while i stack my bag

5️⃣ Summary

Not gonna lie, the team is good

Fundraising skill is good

Getting listed on binance is good

Team Execution skill is good

Protocol UIUX experience is good

Not a fork with some noval LP Tech is good

just high valuation, token captured value unknown, bear market vibes

Hope u enjoyed this.

feel free to follow me on debank or donate to me

0x3Af0e0Cb6E87D67C2708debb77AE3F8ACD7493b5

if u do donate please dm me after!

https://debank.com/profile/0x3af0e0cb6e87d67c2708debb77ae3f8acd7493b5