Earn 37% on ur BTC & ETH Safely, Decentralised

Correlation can be ur new best friend to stack btc n eth yield in the bear market

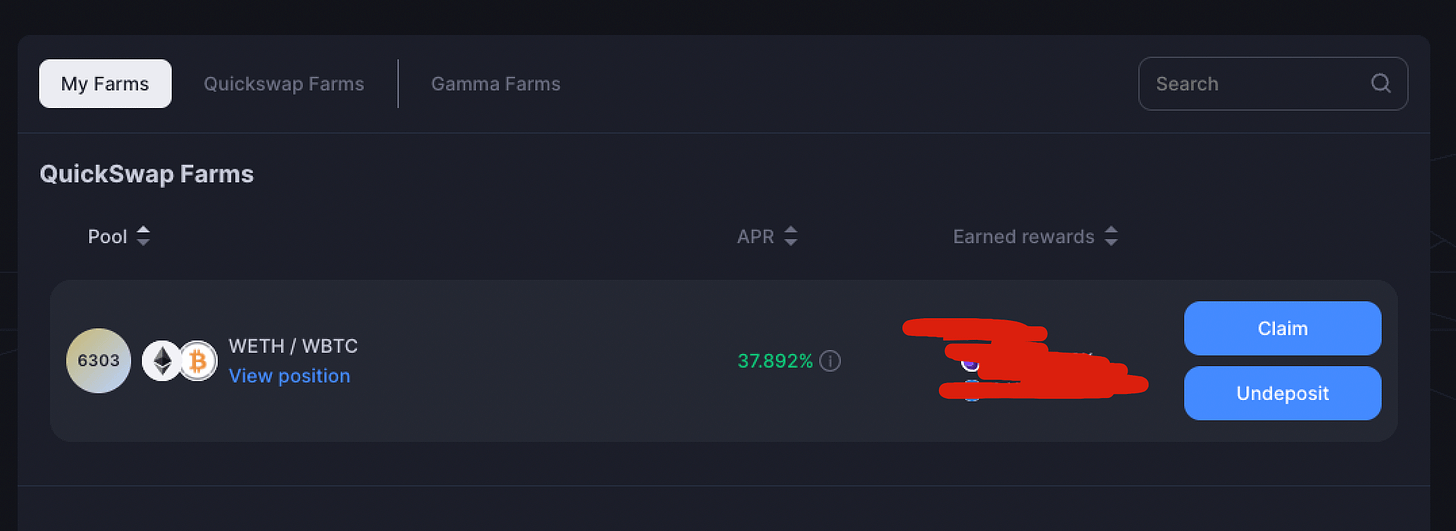

I have been earning 37%+ APY on my BTC ETH Safely

Why just hold BTC & ETH if u can do this?

A strategy that every crypto maxi should know

Sharing my personal position

+

Correlation thinking framework u need to learn

BTC & ETH has a high correlation

If either one goes to the moon, the other will do great too

Why not take advantage of this Correlation?

Providing "concentrated liquidity" to BTC/ETH

With this in mind i found a 37% apy farm on @QuickswapDEX (was 60%+)

This strategy has a strong assumption on correlation bewteen BTC & ETH.

High correlation meaning they go up & down together.

By providing concentrated liquidity in the tight-ish range

u can earn the high trading fee in between yet keeping exposure to "THE BLUE CHIP of crypto"

SO why farm on #zkEVM why on @QuickswapDEX ?

its 15% real yield + 22% $quick

Quickswap is a proven team, dev gud + wont rug

Fee to TVL ratio is gud ( TVL growing quickly tho)

$quick has a thick LP so the farm apr is not fake & exitable

potential zkEVM airdrop

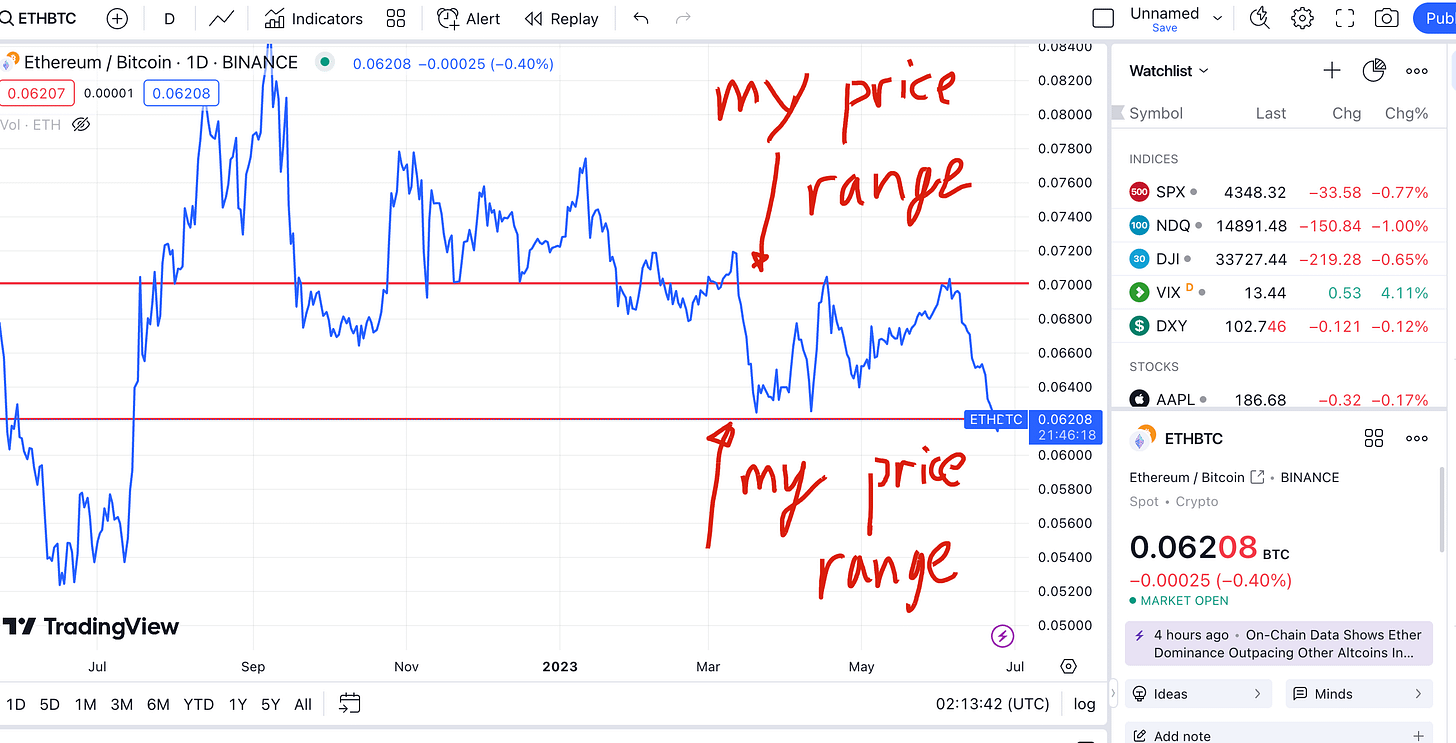

But what at what price range ser?

As always i rather walk u thru my thinking framework so u can develop ur own or correct me!

basically

Tighter the range, Higher the fee

Do u mind selling All the ETH into WBTC? or all ur BTC to ETH?

In case u forget check quoted tweet

Personally i don't know mind selling all my wbtc into eth as i believe in correlation n its just a rotation.

This is my range, n im currently our of range lol

but i think BTC pumped too hard compare the eth lately

i think it will drop back in relation to ETH

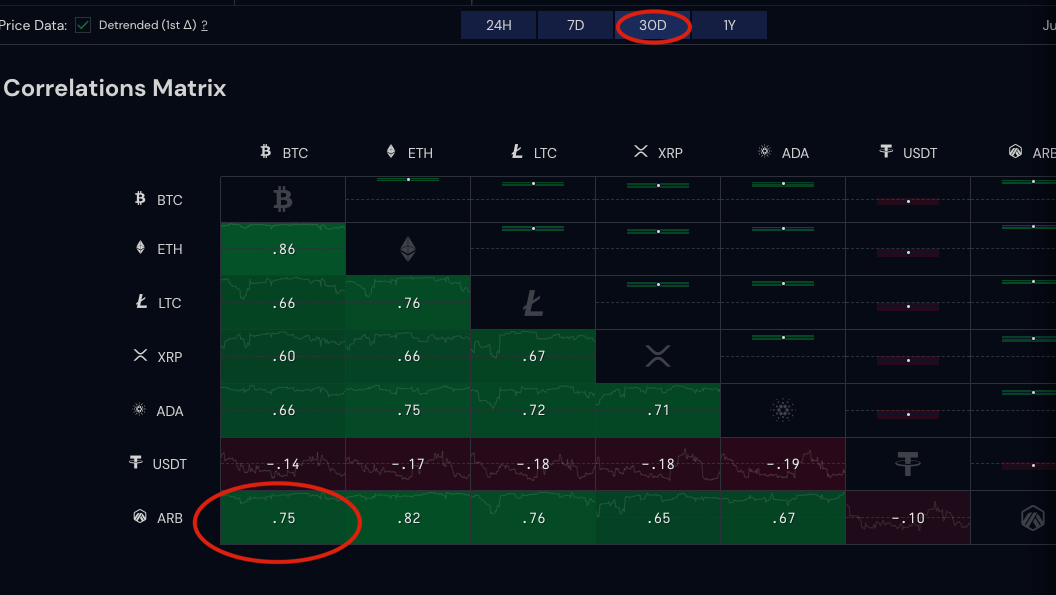

Can this apply to other pairs?

yes, but always becareful of ur hopium assumptions

Rmb $ARB ?

i thought it would have been a good pair too.

But like most things in crypto, it can change over night

Correlations went from .83 (30days) to .38 (24hours)

Always set re evaluation point to check ur assumption

High hopium assumption example :

if ETH pump, ARB has to pump lol

if we were do arb/eth pair, u would have sold ur $ETH into the falling $ARB

A strategy that might have sound logically a few months back lol

Summary

In bear market we want to find the best way or lowest risk exposure to maximise our ability in stacking btc, eth and stables.

This short post aims to bring remind u guys different practical way to stack more.

If u don't have a target price range for btc/eth u can always do uniswap v2 style or tricrypto.

i hope this thread provided u value.

Do they right thing at the right time.

is very hard to find 10x new gems in this market right now.

why fight on level 99 when u can get some easy money ?

yes u could have check what m i doing on debank earlier haha

https://debank.com/profile/0x3af0e0cb6e87d67c2708debb77ae3f8acd7493b5