Want to buy ETH at 800?

why not earn free yield while setting a limit buy order?

Simplfying uniswap V3 for trader with target price range.

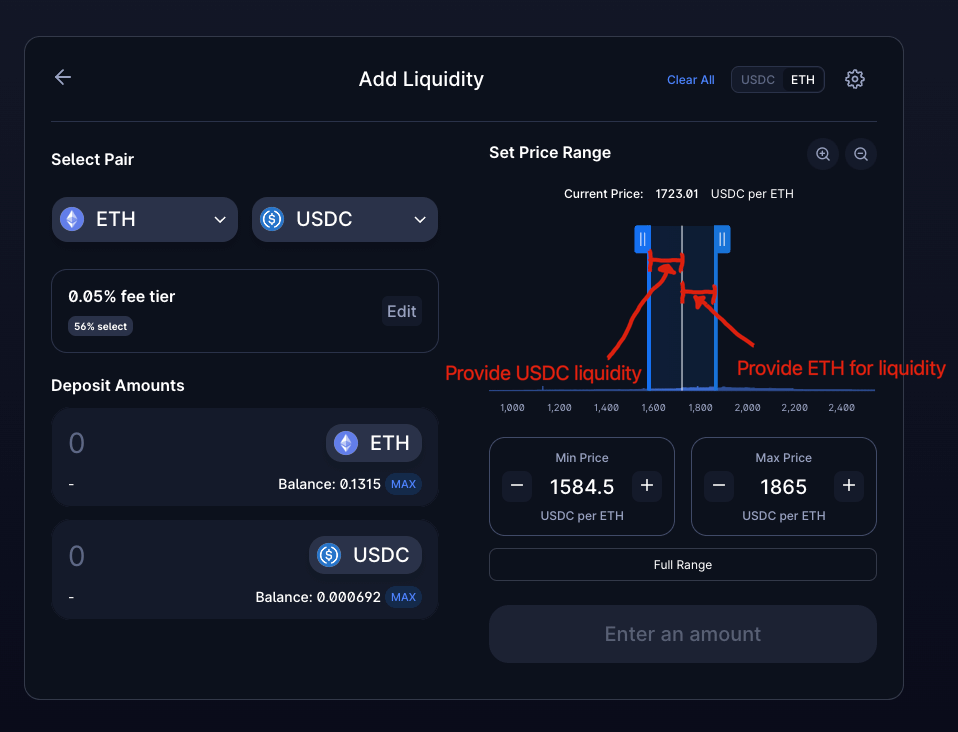

❓How does uniswap v3 work

Uniswap v3 is concentrated liquidity

meaning u can set a range to provide liquidity towards a pair

anything below current ETH price u provide USDC as liquidity

anything above current ETH price u provide ETH as liquidity

⬆️ if the prices goes up it sells ur eth to usdc

⬇️ if the price goes down it buy eth with ur usdc

U earn the trading fee when the price is within ur range

When u go out of range.

Price moved up - all USDC

Price moved down - all ETH

Ok now u understand the basic theory

lets know see how u apply it!

1️⃣ Sell ETH at ur target price + earn yield

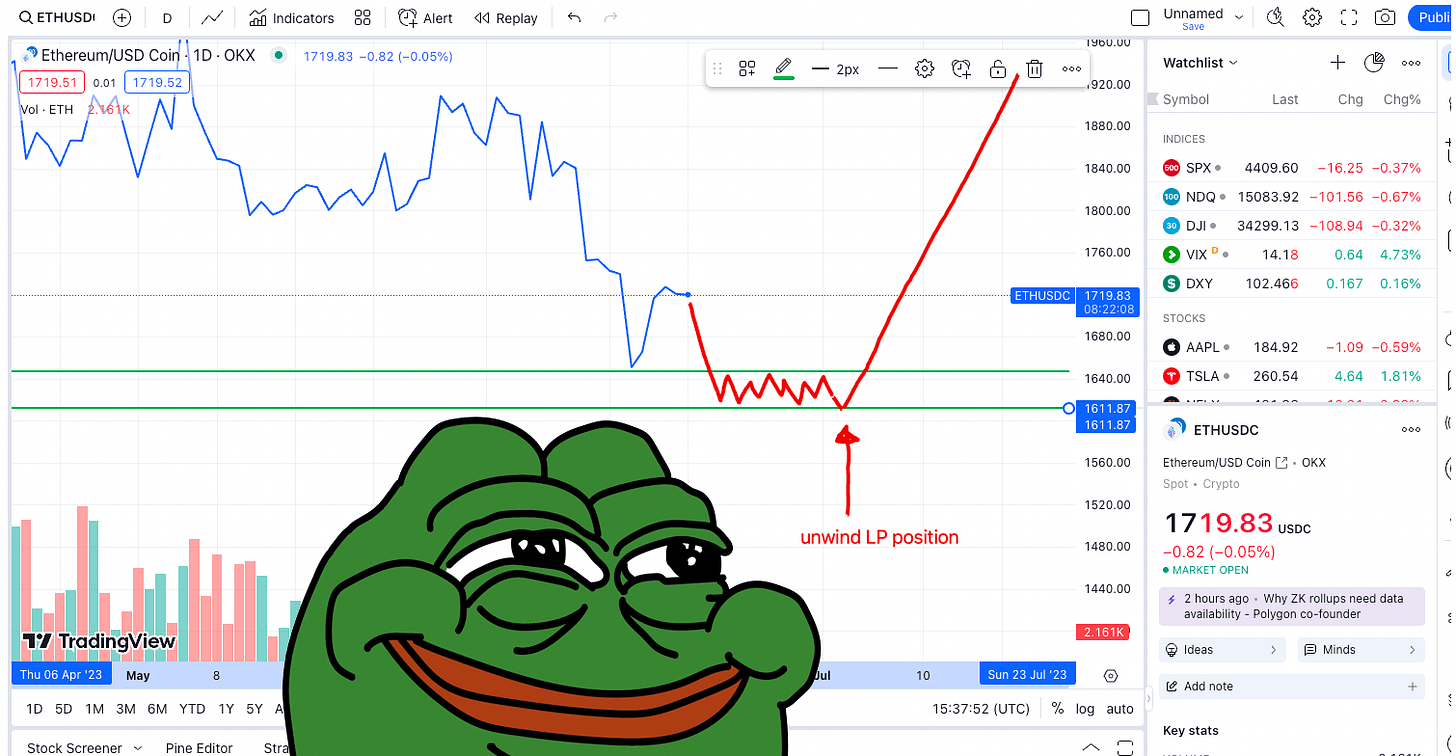

Current ETH price 1721

U are holding eth and u want to sell ETH at 1850

U can set an out of range LP on 1800 -1900

if price goes 1900

will have sold all ur eth at 1850 (avg of ur LP range)

+

yield

u will earn trading fee whenever the price is within 1800-1900

ideally u want it to bounce around a few times with high trading vol then finally reach ur 1900 range!

Once it hit, u can decide do u want to unwind the LP position

like my TA?

2️⃣ Buy ETH at ur target price + earn yield

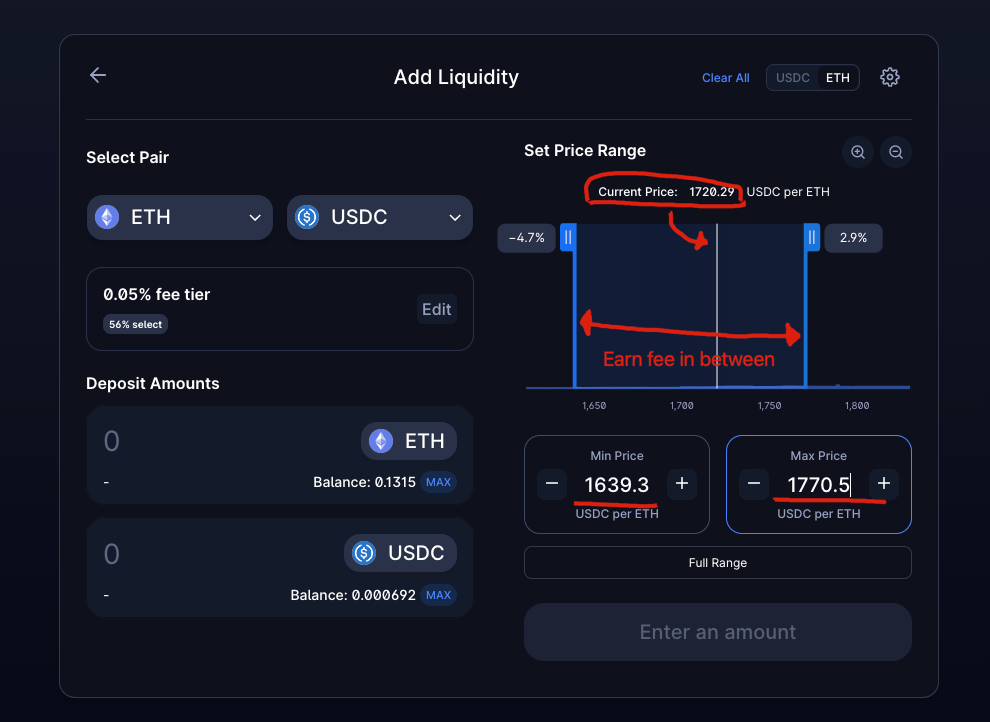

Current ETH price 1716

U are holding USDC and u want to buy ETH at 1630

U can set an out of range LP on 1613 -1649

if price goes 1613

will have use all ur USDC to buy eth at 1631 (avg of ur LP range)

+

yield

u will earn trading fee whenever the price is within ur range

ideally u want it to bounce around a few times with high trading vol then finally reach final "buy" range

Once it hit, u can decide do u want to unwind the LP position, so u will be holding ETH only and let it pump

3️⃣ Earn yield if u think the price will bounce in ur target range

If u it is a crab market and will bounce around this range then u can within ur price range.

The downside of this will be if u are wrong, u will either sell ur ETH holding or end up buying too much eth

This is basically betting on sideways market with a "tighter" range because of ur view towards the market so u can earn more yield as ur capital is more concrentrated within ur target range, hence better capital efficiency

📍Summary

This is a quick n simple approx into uniswap v3 yield farming

personally i think this is more "trading" as u can see

1️⃣ 2️⃣ 3️⃣ does require u to have a "target price" hence it never been that retail user friendly as in a way it has more dimension than V2

Hope u this learn something n weren't too simply for u.

in the following weeks i will dive into more different v3yield farming strategies.

As this is a big topic i will break it down into a few threads so its more digestible for more people.

do share any feedback or request!

I know learning & reading in the bear market with out winning a lot of money is hard, but we know this is the right way.

Hence i started trying to make gif memes for u guys now.

Not because i like making memes, 100%

Great content, and love the memes Lambroz 🤙

Have recently been experimenting with LPing on V3 with the aim to get some yield on my ARB bag, have been playing in 0.3, 0.05 ETH/ARB pools

uniswap.fish has been helpful in identifying pools with good fees

Strategies 1 + 2 are great alternatives to limits on CEX's, do you use a third party to automate pulling you liquidity off Uni?

Strategy 3 - agree with you that concentrated liquidity make this a lot more like trading. We know most traders end up rekt. And looking at the numbers, most V3 LP's are getting rekt by IL and are better off hodl

So weird man, I was just thinking about doing this today. In the past I’d use a cex and just set a ton of limit orders but the past 2 years I’ve been living 100% on chain. Today I started brainstorming ways to best DCA with low to zero fees. So far I’ve come up with using a TWAMM and using UNIV3. I’ve never really LPED with V3 though. You can provid single sided liquidity into univ3? If I wanted to buy ETH, it will let you enter with just ETH?