🥇First protocol that enables leverage position on Uniswap V3

along with allowing leveragoor to take leverage positoin at 0%?

Introducing

@stellaxyz_ by $ALPHA Prev. Alpha Finance Lab

📍TLDR

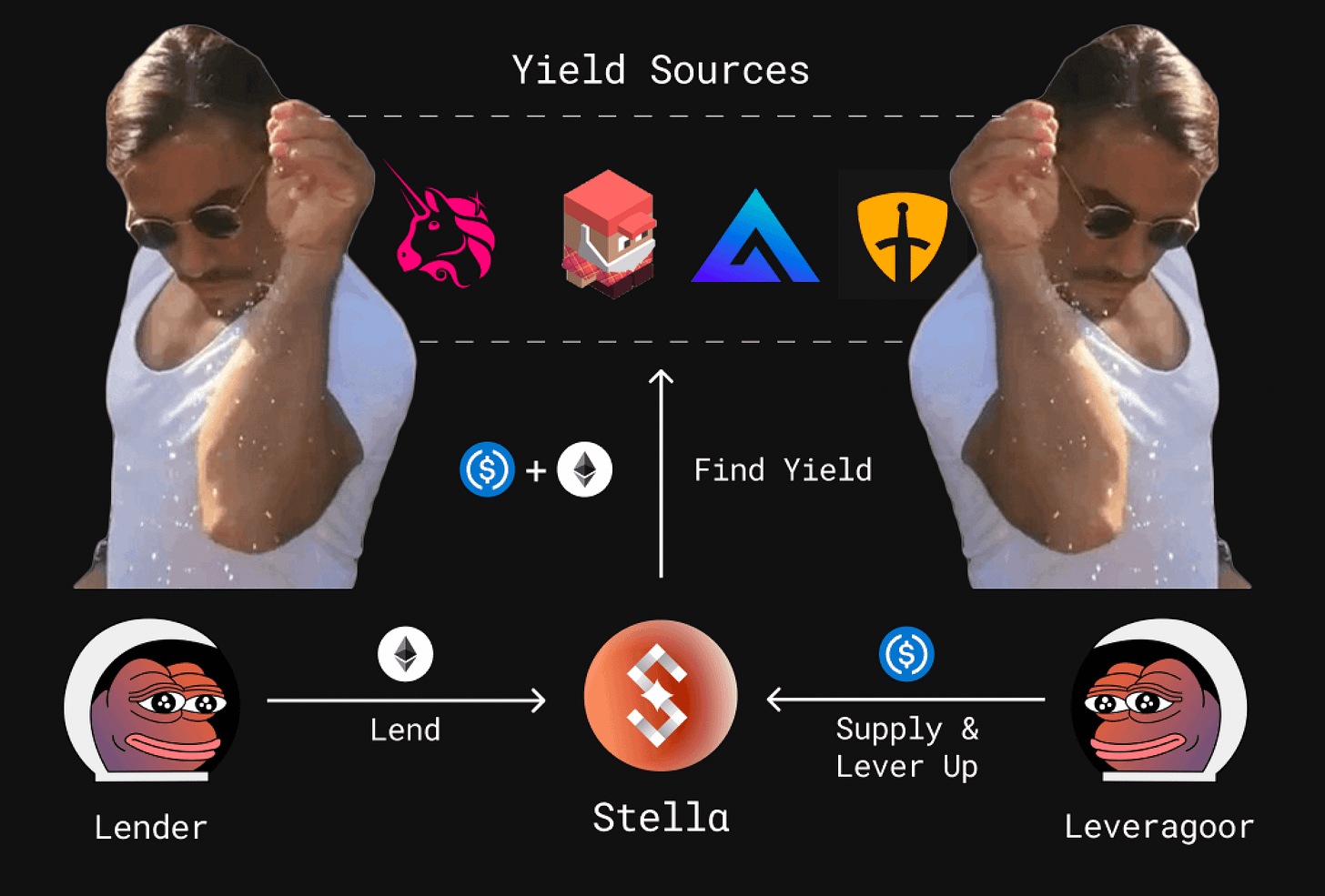

Stella is a leverage strategy protocol allowing user to leverage on dex & staking yield, starting with uni v3

It uses a PAYE (pay-as-you-earn) borrow model, allow users to take 0% cost to borrow.

In this thread

What is Stella

How does it work

Why is it interesting

🔷 What is Stella

Stella is the first protocol that enables leverage position on Uniswap V3.

It allows leverage farmers to pay lenders with part of their profit.

Giving lender exposure of the strategy n allow them to take 0% cost to borrow

🔥No Gain = No pay

Does lender get paid less?

No !

Why?

Because of PAYE model

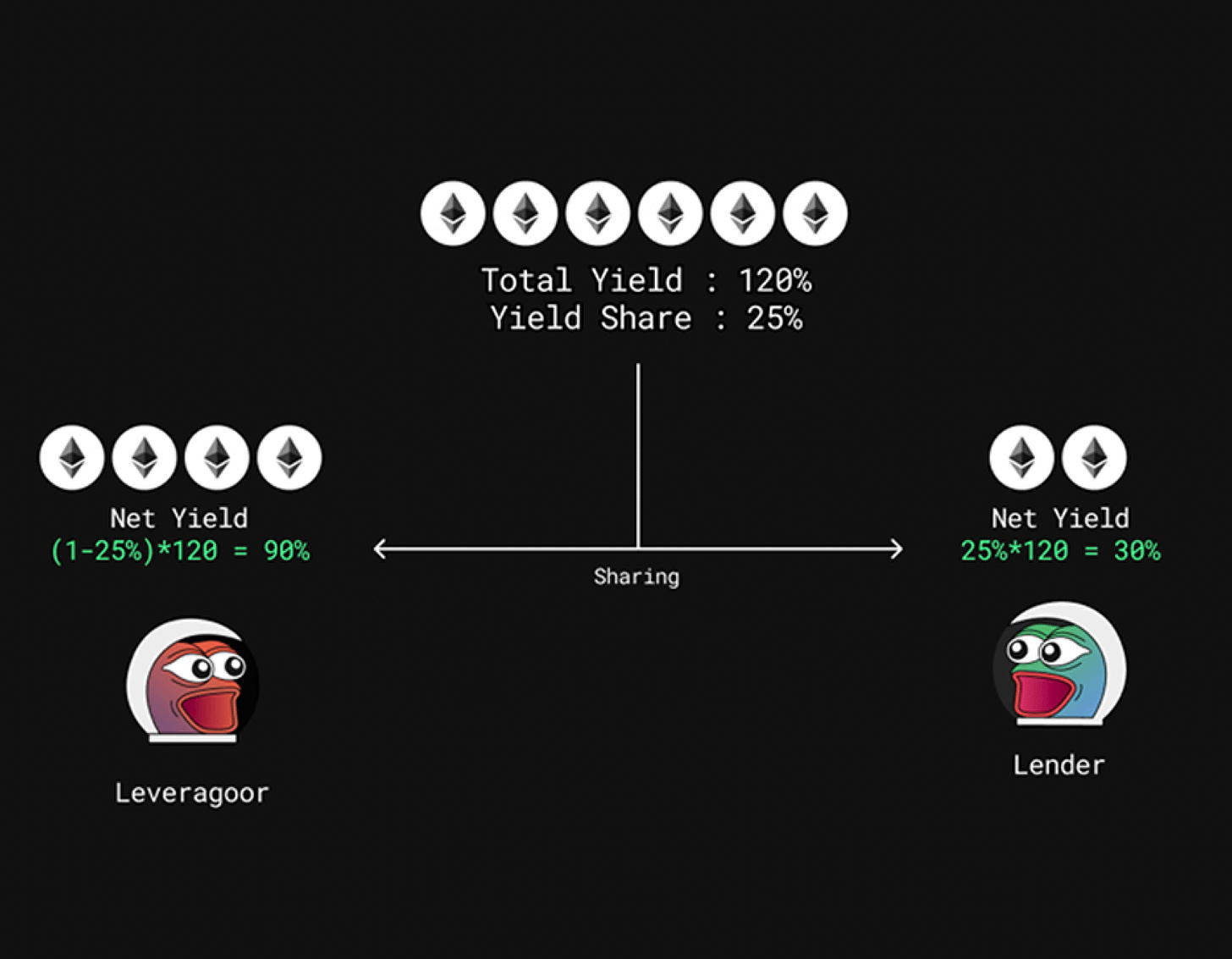

essentially its is a profit share model, lenders will share part of the profit from the strategy.

🌟This is a win-win

👨🌾 Leverage farmers with high conviction can have lower cost in borrowing if doesnt work out

🦺Safu lenders can have no exposure toward the strategy yet enjoy more upside than just lending based on utilisation rate

Why (PAYE) Pay-As-You-Earn?

The typically interate rate model is disconnected from the strategies's yield return.

Lenders earn interest rate based on the utilisation rate (how much is supply n how much is used)

Large positions can spike interest rate, resulting in negative APY

discouraging leveragoor

As DeFi sector matures, there wont be 3,4 digit apy anymore ( RIP )

Stella's PAYE model aligns leveragoors n lender's incentives.

A proportion of leveragoor's generated yield is shared to lenders

Leveragoors will only bear cost when they are generating yield while Lenders will enjoy more upside of the strategies as well

🔷 Why is this interesting

Stella is good for crab & bull market, why?

In crab market

leveragoor can borrow with 0%, lower chance to get negative apy

In bull market

Leveragoors can enjoy high leveraged apy while lenders get a high yield cut too.

Its a win-win

🔷Who is stella for?

2 Modes for 2 different types of users!

Normal mode (borrow by leverage) :

Leveragoors supply assets in any ratio, choose leverage and open position. Asset price exposure automatically neutralized as much as possible.

Chad mode (borrow by asset) :

Leveragoors supply assets in any ratio, also calibrate what assets to borrow. This helps in taking long/short exposure to a particular asset. This is ultimate capital efficiency = UNI V3 + Leverage + asset price exposure.

🛣️Roadmap

launching in June 2023 with strategies on Uniswap v3, Trader Joe

Post launch they will be moving to ETH joining the LSD war 👀

(where V3 LP works very well)

🏁Full disclosure

this is a promotional thread from the team, however as a yield farmer i do this this is a good tool to use.

Alpha finance labs is one of the first OG team that entered the leverage yield farm sector, with proven track record i trust their strategies.

v3 position have high capital efficiency and sometimes higher IL at the same time.

These strategies need to be used with caution but also enables high APY.

Quite excited for their product, i can't wait to play around with it specially their LSD strategies.

YO WHAT IF I TOLD U CAN FOLLOW WHAT I DO ON-CHAIN

https://debank.com/profile/0x3af0e0cb6e87d67c2708debb77ae3f8acd7493b5