Flashstake

unlock your yield upfront instantly, potential LSD sector gem/ good tool?

🐏In the thread

What is Flashstake

How does it work

What can you do with it

Opportunities & challenges to overcome

Summary

But first, those 90 people that almost read my email daily

📍What is Flashstake?

Flashstake allows users to receive yield on deposits assets instantly with a fixed rate over a set duration by the users.

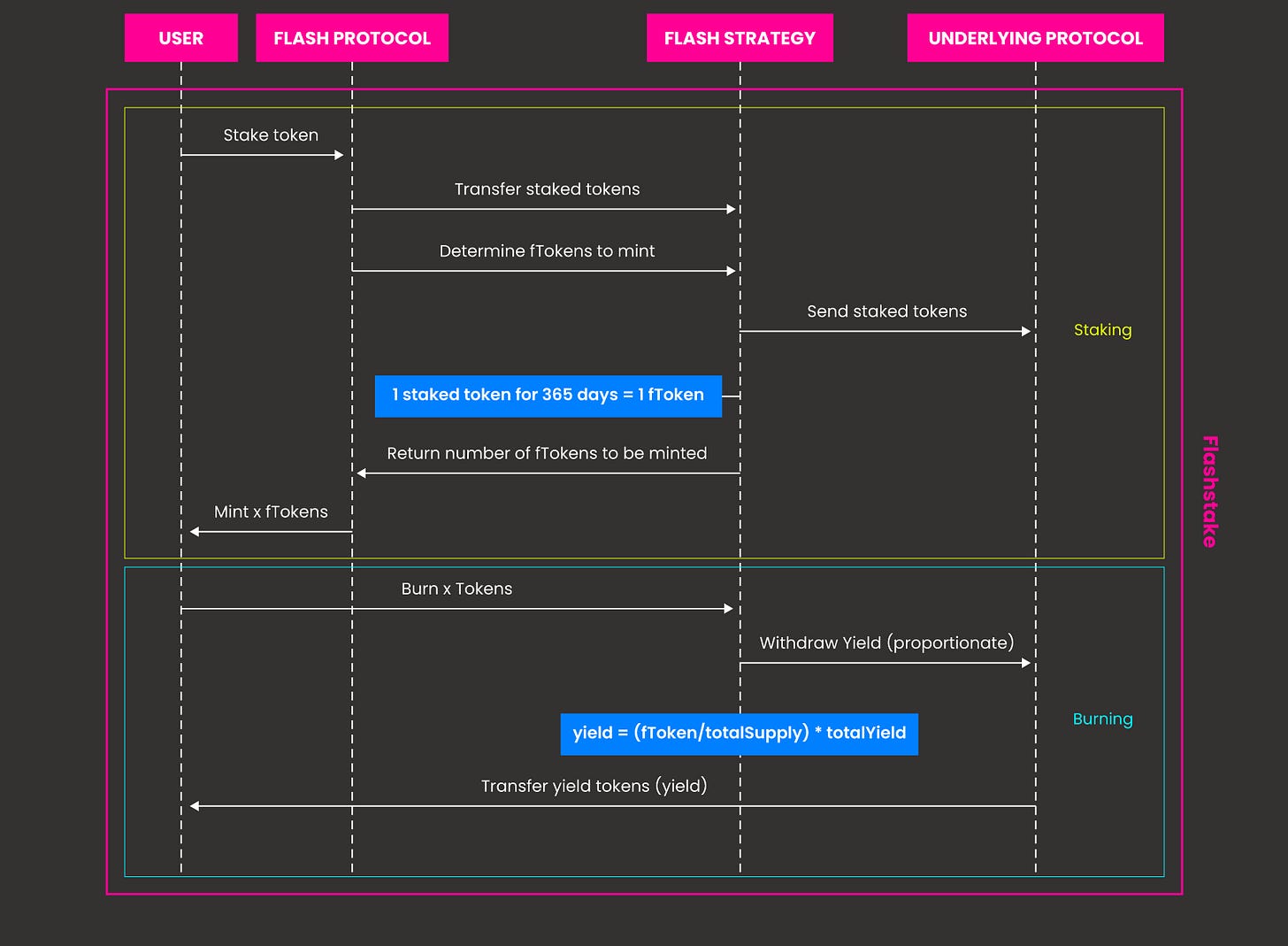

📍How does it work?

There are two type of stakers in the protocol,

Flash staker

Normal staker

Flashstakers

Flashstakers select the length of their “stake” and collect upfront fix yield. They can collect 100% of their initial deposit once by the end of their

Normal Stakers

3 key components of “normal” stakers

Stakers can stake for ftoken.

ftoken will represent a % of the total pool of yield.

Normal stakers can stake & unstake anytime.

Users will get ftoken of the chosen strategy upon staking and they can burn (redeem/unstake) their ftoken for their % of the yield pool anytime

The total pool of yield = yield generated from strategy - Yield given to flash stake user.

📍What you can do with it?

✳️Unlock instant yield

If your stablecoin bag was UST or locked in FTX like me.

You can stake your ETH and get instant yield for liquidity. This is very different from using my ETH as collateral to borrow stable as im only giving up potential extra yield instead of paying interest to your loan (although you can argue you can get more liquid from borrowing)

✳️Speculate on yield

Essentially you can use “flashstake” to lock in yield and “Normal” stake to speculate yield going up indirectly.

If you think the strategy’s yields are going down, you can flashstake to lock in a higher rate.

If you think the yield is going up you can “normal” stake and earn the “extra” yield that the flashstakers given up for instant yield unlock

📍Opportunities

✳️ETH LSD narrative, as one of the biggest events coming up, flashstake is definitely within this sector.

✳️With ETH being able to unstake after the Shanghai upgrade, this potentially opens up various strategies with high capacity for stakewise to build on top.

✳️Stakewise is a framework that can be build on any strategies with more users, the team can built actually build on

Leverage st ETH strategy

Glp strategy (stakewise version) ?

Flashstake for fundraising & liquidity mining? (mention in their medium )

📍Challenges

Flashstake heavily rely on yield source, ideally the yield source needs to be sustainable with high capacity.

I’d imagine to bootstrapping a new pool on stakewise requires a lot of “normal” stakers, given the yields on DeFi market right are limited, there are limited strategies that stakewise will be able to build on.

📍Summary

Stakewise is a good and simple yield tool. The team is solid, extremely quick and responsive on discord and one of my favourite kol @thedailygwei seems to be a fan of it.

The team seems to have chosen to focus on educating “flashstake” users.

As someone that likes to understand the whole protocol before aping it took me a while + help from @ZacharyDash ( responsive nice guy) in discord to understand the concept.

After liking & understanding the protocol i started to explore how can i invest into flashstake and realise the utility or function of the token is not listed on their gitbook or their website.

I’d love to find out more about the protocol in the future, from the style of their gitbook they are definitely true builders but potentially focused on the technical too much.

It might take some time to explain to the general crypto community but I always like true builder teams and I think this might be a hidden gem.

Thanks for reading! like or retweet if you got here