So u got ur @CelestiaOrg airdrop, whats next?

List of actionable and guides on what u can do at least know ur options before aping or ape selling keke

Content List

1️⃣ TLDR what is Celestia & TIA token uility

2️⃣ Stake as delegator

3️⃣ LP on OSMO

4️⃣ Quasar LP strategy vault

5️⃣ Grid trading ( high risk )

6️⃣ Bybit promotion stake

7️⃣ Thoughts on TIA & potential up coming strategy

8️⃣ Additional reading materials on Celestia

1️⃣ TLDR

Celestia is a modular blockchain seperates execution, consensus & data availability later (DA)

by focusing on handling the DA (with their DAS tech) they are able to scale and allow other rollup or chains to build on top or integrate it

It is essentially a blockchain lego

1️⃣.1️⃣

Token uility

🔹 Gas token

🔹 Staking rewards as validator or delegator

🔹 Governance

My thoughts & TIA valuation at 7️⃣ ( making u read the whole thing kek)

2️⃣ Stake as delegator

Earn 33% apr

remember to select the one with high voting + low comission

don't stake to any validator with 100% comission

it requires 21days to unstake

If u are new to the cosmo ecosystem

u can check out one of my favourite cosmo kol @L1am_Crypto 's tutorial

Big fan of his work

3️⃣ LP on OSMO

@osmosiszone is the top dex on cosmo chain with concentrated liquidity

Day 1 trading vol was 9m on a 400k pool with 4.5k fees

around 400apr, although the trading volume likely wont last but its still a high apr farm.

U can also set target price to sell while earn trading fee on the way down.

@osmosiszone 's concerntraded amm works similar to uniswap v3

U can essentially set a LP position that slow buy or sell ur bag.

check my old thread to understand more

4️⃣ Quasar LP strategy vault

It is essentially the @GammaStrategies of cosmos.

It is built on top of @osmosiszone

It will help u reset ur LP position so u stays in range and able to earn fee

It's cool but it doesnt provide any backtest or strategy parameters

not sure

it's performance under highly volatile token as IL might kill the pnl

5️⃣ Grid trading ( high risk )

During price exploration of a newly token if you have a clear target price range grid trading is a useful tool.

As it helps u sell as it pumps upwards in ur range and buy when it starts to get into ur lower bound range

Essentially this is how it works. As u can see from @ale_awu 's chart TIA rallied a lot, grid trading can help u capture these movement

But this is only smart if u have a target price range

Risk

if the price only goes up, u would have sold all ur TIA

if it continue to drop u would send all ur usdc buying the dip

6️⃣ Bybit promotion stake

NOT affiliated with @Bybit_Official anyhow

just sharing one simple way to share their free 25k TIA pool

7️⃣ Thoughts on TIA

🤔Utility, Hard Market Demand

From earning point of view, it will be based on

How much traffic per rollup have

How many rollup will use celestia

This will depend on will well their BD is, how good their tech is and techically easy to integrate

✅Speculation

😉 Hopium side

It hits a lot G spot of narrative

- EIP 4844 ( however delayed )

- Modular blockchain

- App specific chain

- Rollup as a service

- Rollup fee

- Multichain world

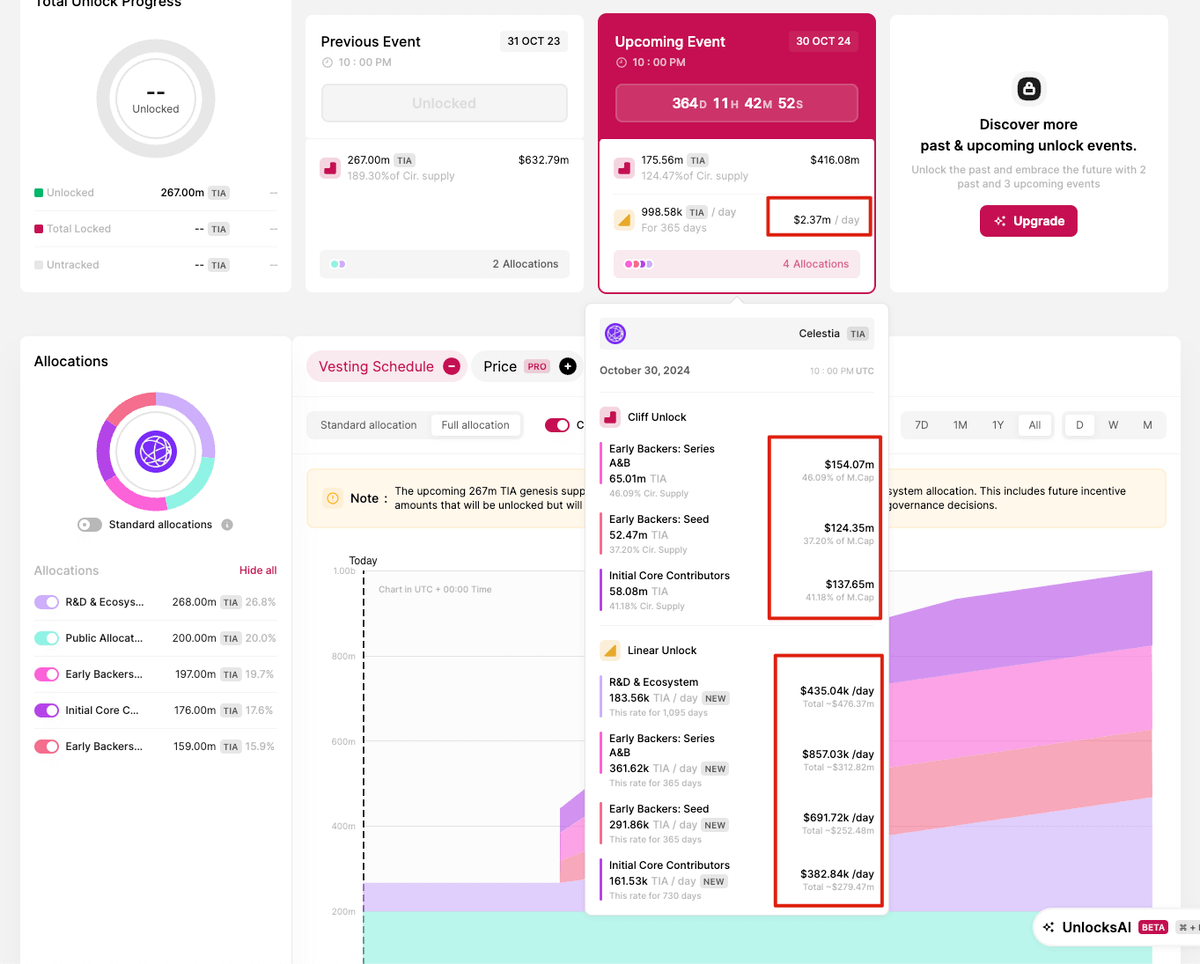

🤒 Downside

- Retail won't understand the concept, this will heavily depend on their b2b marketing or retail key metric image

- EIP4844 likely delay

- High amount of unlocking

🐑Summary

Personally I haven't workout my "fair" valuation for @CelestiaOrg yet but reference will be rollup fees assumption on growth.

I personally did not buy any on spot and basically sold everything n kept some just to test things out.

I do like the project but i think EIP4844 official delay n sell pressure from early investor does the look great to me short term

i plan to re-evaluated TIA if on-chain activity or number of rollup increased significantly, EIP-4844 launching or realted projects like altlayer tge

Potential Strategy ( working )

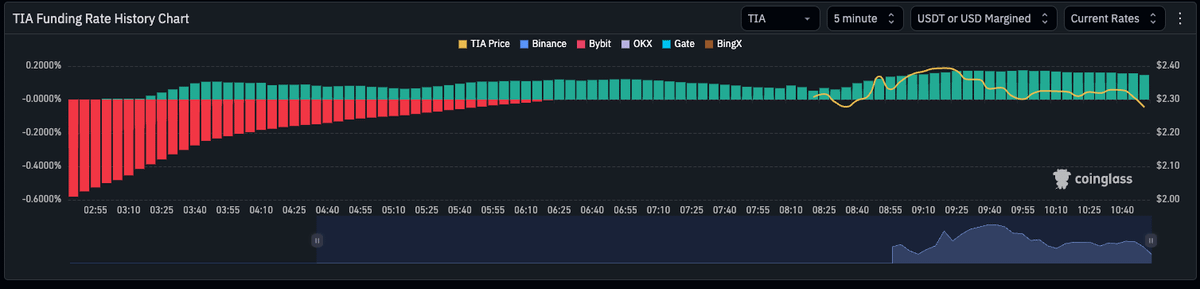

Delta neutral Funding rate arb

- Currently you can single stake on the two options above while earning some funding rate fee on different perp

- So u can earn funding while shorting ur single stake position on POS (33% apr) or Bybit

Key to note that TIA's POS yield is around 8% a year. As more people stake on POS the apy should lower to 8% as TVL grows and the funding rate should converged to 8% apy once the high speculation OI drops

If u enjoyed this and wanted to be early on stuff u should join us

some of the strategy and early claim info was from the group chat