Welcome to our

7 newly lambro substack & 978 substack frens now

26 new twitter followers, join the 13.412k 2lambro Twitter frens

403 frens in “Medium Rare 🧑🍳🥩🤌” Telegram group chat members !

Medium Rare 🧑🍳🥩🤌chat for DeFi Lover

We are still early, learning, growing with u guys since january 2023

How MakerDAO is changing DeFi? What is DSR? Proposal just past on increasing it to 8%

This thread will go over

▶️ Impact on DeFi sector

▶️ Bullish on $MKR, RWA?

▶️ Risk

▶️ but is it really decentralised?

TLDR

📍DSR act as yield bearing vault like a saving account with a bank.

Dai holder can deposit it into DSR to earn 3.19% currently and proposal just past to increase to 8%

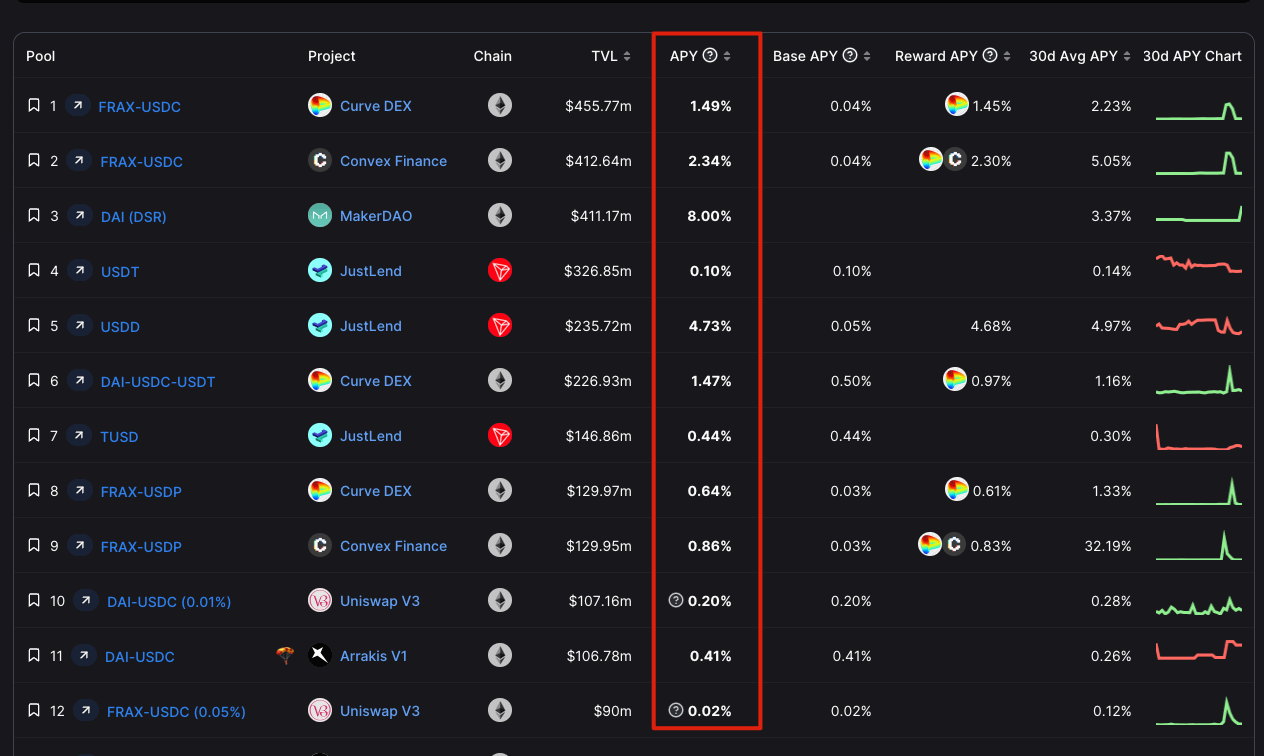

📍DSR "risk free" yield is 8% is attract compare to stablecoin yields on the market with a high capacity

📍Bullish signal for $MKR if DAI captures more stablecoin market share?

❓What is @MakerDAO

Maker is a peer-to-contract lending platform.

User can deposit asset into the protocol to mint stablecoin $DAI

$MKR is a goverance token to vote on upgrades with a buyback based on fees from protocol

TLDR of relationship between $MKR and DAI

More adoption of DAI

More Fee generated from stability fees

More buy back of $MKR

* MakerDAO keeps a buffer of 50M DAI, when the surplus this buffer, the exceeding amount is used to buy back and burn $MKR

Can checkout makerburn website

▶️ Impact on DeFi sector

With DeFi stablecoin yield being low due to low trading fee n lending utilisation rate.

DSR as a low risk yield is attractive this will further push down the interest of DeFi user providing liquidity for swaps & lending on top of the recent hacks

▶️ Bullish on $MKR, RWA?

Yield returns are often the best way to capture users. remember luna? kek

▶️ Makers Revenue has exceeded expenses

(rare case in crypto lol)

with continue trend and annualized profit of 84m leading a sexy 14.6x P/E ratio

▶️ MakerDao is yield is NOT emissioins with high capacity (RWA)

▶️ Sitting on one of the biggest protocol for RWA narrative

Feel free to read more on @yieldinator bullish case on $MKR

▶️Risk

a16z sold their last token last week

@_portersmith from a16z has mentioned introducing MetaDAO will not improve the situation of regulation.

"quote from a chinese article @TechFlowPost" might be lost in translation a bit.

💡Personl thought

If you are investing into any RWA, regulation or potential change of regulation will always be a risk u can not control

Investing into DAI for 8% or just take a small size bet on $MKR as happy delta?

i prefer to take small happy delta

▶️ but is it really decentralised?

Summary of thoughts

in short Bullshit on $MKR

Worry this will further suck money out of DeFi

Got me thinking...

If people are actually just looking for 8% yield y r they still in DeFI?

the more people enter DSR = more people bearish DeFi?

Can i say DSR is just an easy way to off-ramp to on-chain yield?

Join in on this conversion

https://t.me/+GyRvq_wp-To1ZjJl

Additional info

MakerDAO's Endgame with @RuneKek