Intent based perp

Perp without liquidity provider

Raised 2.5m from @Castle__Cap & @Magnus_fund

New type of Perp?

Learn everything about @IntentX_

Content preview

🔹 What is intent X

🔹 How does it work

🔹 Why trade here instead ?

🔹 If there is no LP, who are trader trading agasint

🔹 Advantage & Disadvantage of this design

🔹 Tokenomics explained

⭐ ACTIONABLE

I hope I have provide you joy, alpha and value throughout my 179 post since Jan2023.

For my loyal readers & community, I apprecate all the dms & support msg throughout my ups & downs this year!

I will keep this substack free, but if you ever want to support me feel free to join my subscription

🔹 What is intent X

Intent X is a Perp without the need of liquidity provider unlike GMX

It's intent-based trading architecture allows market makers to act as liquidity for traders

Allowing cheaper fees & more tradable asset

Without dependent of LPer values goes to token holder

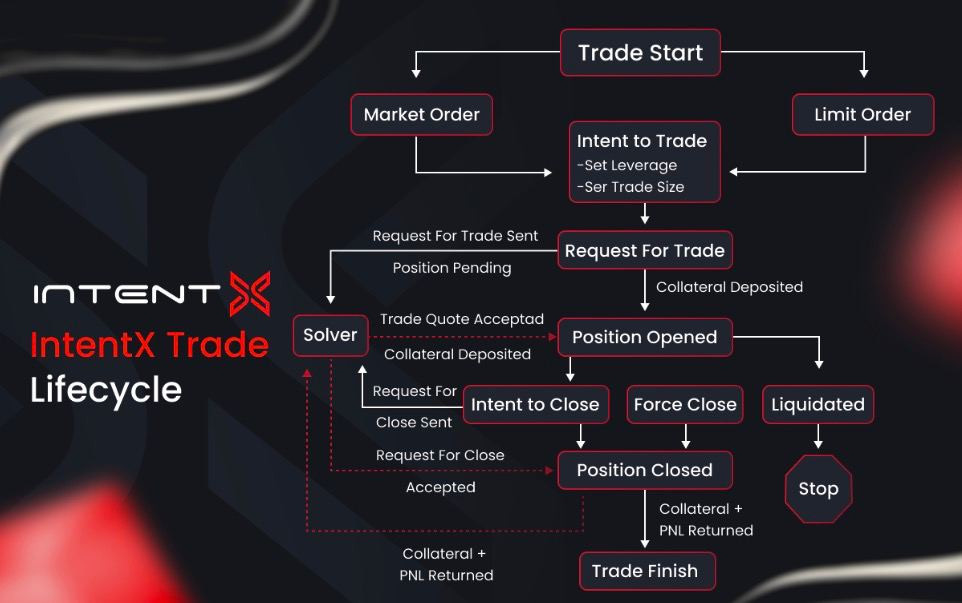

🔹 How does it work

An intent is a trader's ability to express their desire to trade a position on IntentX

1️⃣ Express intent to open/close trade

2️⃣ Request for Trade or Request for Close

3️⃣ Market maker hedges position and accepts request

4️⃣ Trade opened or closed

🔹Why trade here instead ?

✅ More pairs to trade

✅ Deeper liquidity ( get up to 60x leverage )

✅ Lower fees

✅ Seamless execution

✅ Programmatic guarantees and security

✅ Great UI/UX + Account Abstraction

Most importantly for speculators

✅INTX Trade to Earn Incentives 💸

🔹 If there is no LP, who are trader trading agasint

Market makers!

instead of peer-to-pool model like GMX

trades in intentx are directly peer-to-peer with market maker's help

This allows listing pair without boostraping liqudity from public with liquidity mining incentives

🔹 Advantage & Disadvantage of this design

✅ There is no LP, more protocol values goes back to token holder or trader ( trade to earn, referral emission etc )

❌ If there no LP users are trading agasint market makers, and if its not profitable why would market maker stay there?

Comparing to other perps it's not really a simple better or worst design answer,

The approach is different, utilizing MM enable more pairs quickly & effectively ( depending on MM quality as well )

In the end of the day, perp dex is about how much trading volume can they attract

- Expanding on trading vol in case u don't perp onchain

As a trader, as long as u are happy with the UIUX, trading fee and the spread ( + possibly trading incentive ) u would trade there

as a on-chain perp the spread is around 0.1% &

gains spread is around 0.04%

Looking into the tokenomics

There are 2 tokens $INTX & $xINTX

TLDR if u don't stake INTX into xINTX

u don't can't get any protocol value

the uilities of $xINTX are

100% of revenue distributed to xINTX stakers

Long-term increasing share of protocol through the exit fee mechanism

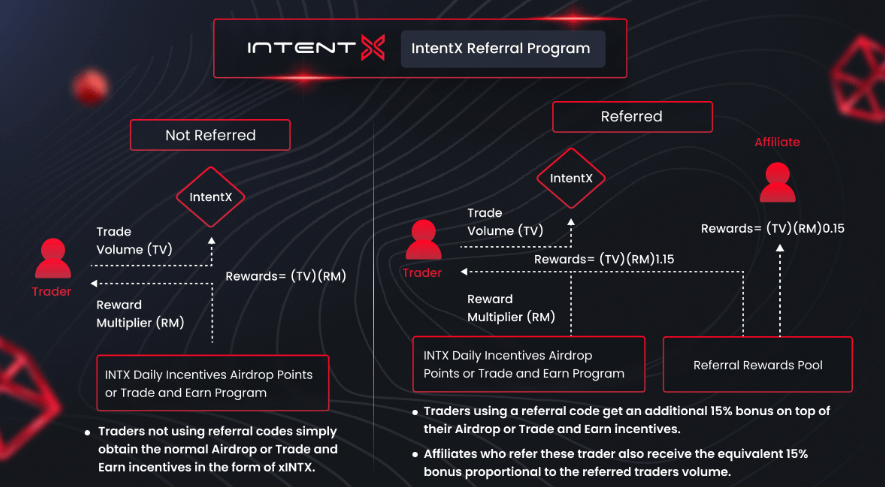

Increased Trader Incentives & Referral Program Rewards

Access to unique strategies and products (Solver LP)

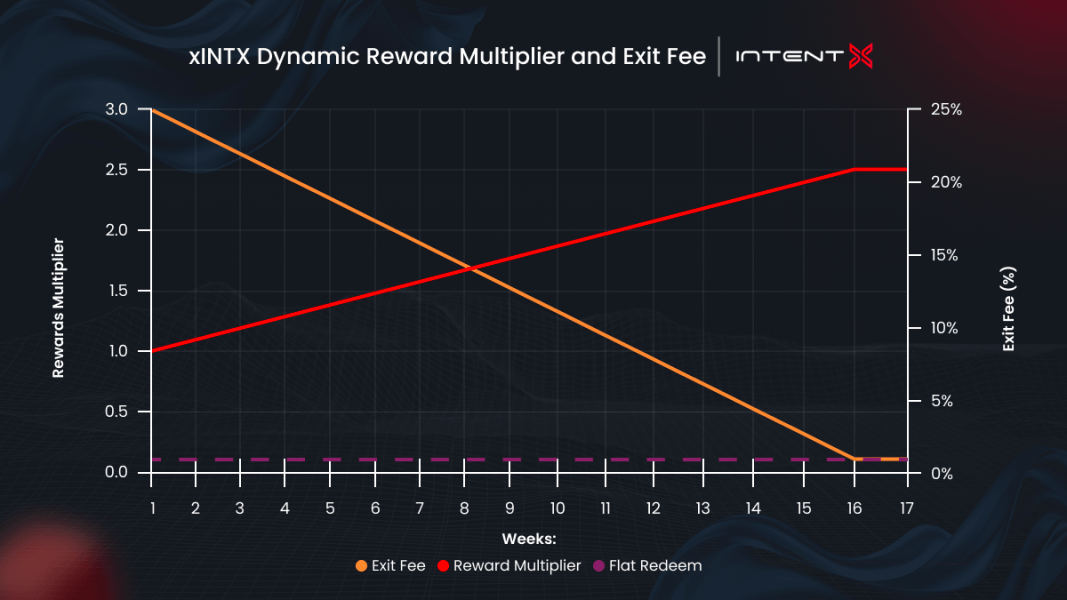

xINTX staking machanics

INTX is staked to xINTX 1 to 1

Dynamic unstaking machanism, where the earlier u stake the more xINTX is charged and redistributed into the pool

The longer your xINTX is staked, the higher the reward multiplier is

🔹In conclusion

xINTX machanics wise is designed to incentivize people to stake, earn protocol fee + early unstaker fee.

The some game theory between when to unstake for the most optimal tokens & price

It's TGE & Valuation is unsure yet. will update when they have list the info

⭐ ACTIONABLE

2% of supply is for airdrops for early traders & zealy adopters

Additional to early traders & Zealy adopters program

U can also use my referral code for additional 15% xINTX reward bonus

https://app.intentx.io/?referral=2lambroz

This is NOT a sponsored post.

i just enjoyed their product n think its worth keeping an eye on

I hope u find this insightful or valuable somehow.

Feel free to support me in my substack, use my referral links

or just come chat with me in medium rare!

I will keep this substack free, but if you ever want to support me feel free to join my subscription