U probably been f*ck by tokenomics somehow

Tokenomics is a chess game, the battle between you, project team & VC

Have u ever bought a good project but price never reflected it?

u probably got fked by tokenomics

Tokenomics is a chess game, the battle between you, project team & VC

Heres my "Tokenomics Framework"

Quick 3mins read from my 4 years of learning, trust me bro is good

In crypto people like to throw keywords at u like

deflationary! 3,3 !! duo token!!! trible token !!!!

these are all smoke screen to fomo u

3 Key things to understand so u aren't the exit liquidity

1️⃣ Token Demand & Supply

2️⃣ Token Distribution

3️⃣ Token Dynamic & Vesting

1️⃣ Token Demand & Supply

Who is buying n how much is there to buy,

More buy power n less tokens to buy, number will go up.

🔹What is the Utility of token?

🔹Does it capture the protocol value?

🔹How much buy power can the utility drive?

🔹is it quick short term demand only?

E.g. launchpad tokens, people rush to buy to access good ido but dump it as soon as the quality of the project launching drops

🤡put numbers into "utility" most features sound cool but in reality doesn't drive enough hard demand to support the price

❓Whats the supply of the token

Is it fix, inflationary or deflationary?

a lot of project claim to be "deflationary" but the only thing they deflate is price n fart.

🤡Put some numbers to it, most uility driven deflationary won't even take out 1% of total supply lmao

2️⃣ Token Distribution

Projects uses different terms, team, early contributor, marketing, treasury.

again, back to basic. just ask urself who is holding the tokens.

🗣️Project team

🗣️Seed investor

🗣️Secondary buyer

🗣️Protocol incentives

Don't let those different name confuse u, in the end is just these 4 guys

Who is holding the most?

What did they pay to get these shares?

How would they trade the token?

e.g.

Without naming projects, a lot of dex's "protocol incentives" might hold the highest tokens and if u are a buyer or seed investor u will have to take part in protocol activities to make sure u don't get diluted.

or be the farmer to dilute them kek

Dirty tricks team can do with tokenomics

"airdrop" or "incentives" actually drops to their wallet

"advisors, marketing, partnership" is a blackbox,

"mint NFT for tokens"

indirectly raising another round

3️⃣ Token Dynamic & Vesting/emission

A lot of tokens like to have various factors that can affect it's preformance such as staking, burns, lockups, taxes

E.g.

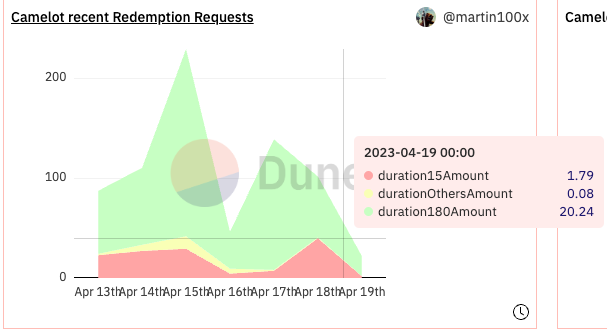

Like $grail from camelot has a 180 unstaking or 15days unstake but 50% of the grail will be burnt.

If they are on chain u can probably find a dune dashboard or ping me about it

🫵if u are buying that token at least understand it's game rule!

❓Why is vesting/emission improtant

Are u gaining more % of the protocol or getting diluted?

if someone else is getting more % of the token are they selling it? or staking it for even more emission reward and protocol revenue?

Using $Looks as example

Airdrop was 80% of the initial mcap, but only 25% of the mcap 6 months later.

If u decided to just hold the airdrop, even if the price went up u are technically diluted "owning" less of the protocol.

If u are thinking as an investor u have to think in

what is the total worth of the protocol

+

the % u own in the protocol

Good thing about tokens is that u can also take part in different activities to earn more % such as volume reward staking reward in $looks

Tokenomics is like chess,

Its a battle of Project team, Seed investor, Secondary buyer, Protocol incentives

U have to seeing who getting more tokens, is the protocol value going up overall?

If the token undervalue what is the best way to accumulate or if its overvalued can u sell before other players has more tokens?

Always remember people value & react to things differently in bear/bull markets.

I have been awfully sick for the past two weeks and couldnt focus to write more. getting back online more now, to the ones that notice i haven't been posting n sent ur regrads, thanks again.

lambro felt the love

Till next time!