Welcome to our

+4 newly lambro substack & 998 substack frens now

23 new twitter followers, join the 14.66k 2lambro Twitter frens

584 frens in “Medium Rare 🧑🍳🥩🤌” Telegram group chat members !

if u think u have insight or jokes, dm n apply to join!

We are still early, learning, growing with u guys since january 2023

AMA that made everyone understood @TimeswapLabs

No marketing flare, no bullshxt just good learning

Heres a Recap of the first

🧑🍳🥩🤌 Medium Rare Product driven AMA

+ @TimeswapLabs token leaks

What you can learn from this AMA recap

1️⃣ What is Timeswap

2️⃣ Potential Strategy/ Arbitrage on APR pricing

3️⃣ Token leaks + 1 thing lambro is looking for

1️⃣ What is Timeswap

🐏 view:

using lending to create an options that behaves like dual investment

Currently expending into wide range of asset with time frame of 1-3months typically

Before jumping into an example here's 🐏 quick word for u to understand how to think of timeswap as a tool

How does it work with plsARB/ARB example

Lender’s POV, as screenshot.

1. Maturity

the time at which the pool expires (borrowers have to repay, else their collateral gets forfeited; lenders will receive their full amount at maturity as per the interest rate they locked-in)

2. Transition price:

the price level beyond which borrowers are expected to repay the loans (or not). In the exact case as the ss, if at maturity, plsARB/ARB falls under 0.30, borrowers are expected to not repay and lenders will receive plsARB.

On the right u can see 3 - 7.

3. APR:

Lenders will earn a fixed 9.99% APR by lending ARB; Borrowers pay a fixed 9.99% APR to borrow ARB.

4. CDP:

The overcollateralisation ratio of the loans. The inverse of LTV.

5. Spot price:

The spot price of plsARB/ARB, for UX purposes only

On the right u can see 3 - 7.

3. APR:

Lenders will earn a fixed 9.99% APR by lending ARB; Borrowers pay a fixed 9.99% APR to borrow ARB.

4. CDP:

The overcollateralisation ratio of the loans. The inverse of LTV.

5. Spot price:

The spot price of plsARB/ARB, for UX purposes only

6. Case 1:

If plsARB/ARB matures above 0.30, Lending 100 ARB will yield 100.96 ARB

7. Case 2:

If plsARB/ARB matures under 0.30, lenders will receive their principal and interest in the form of plsARB. Lending 100 ARB will yield 336.54 plsARB

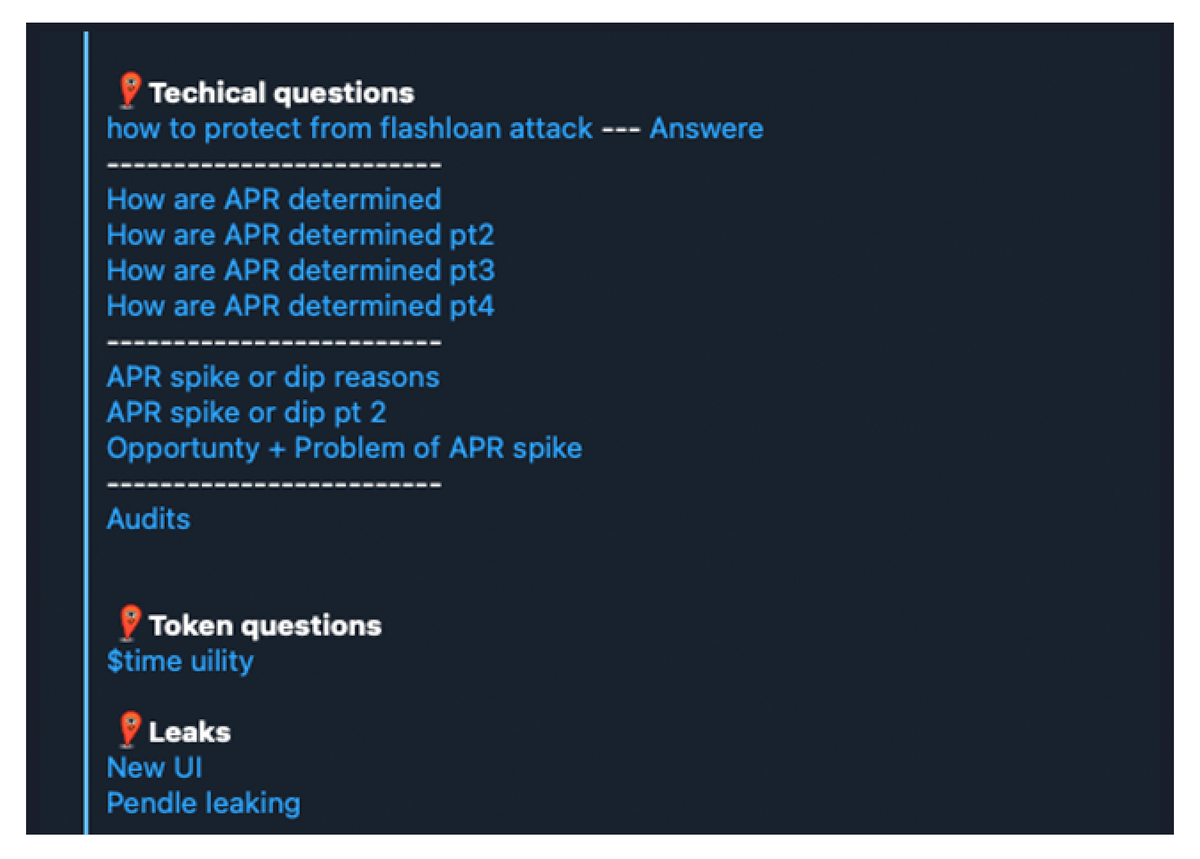

More great questions from on how to use the protocol such as

🤔 Is the lending rate fixed?

🤔 Can u exit the position early?

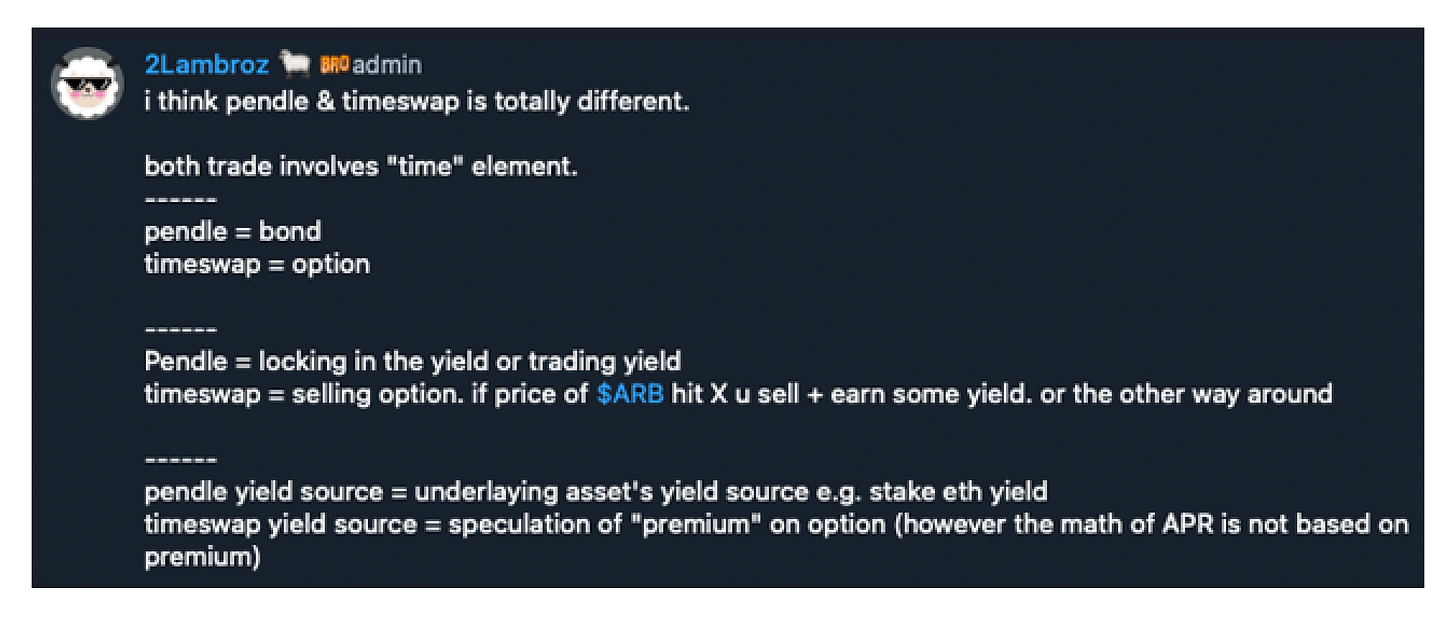

🤔 difference between timeswap & @pendle

2️⃣ Potential Strategy/ Arbitrage on APR pricing

Our smart Medium rare community also started digging into more techical questions, Time token & leaks

(Screenshot is a recap link of the AMA group chat recap)

👀

One key interesting is that

timeswap has a option like character yet pricing of an AMM, hence there are likely arbitrage opportunty as the volumes goes up

Difference between timeswap & @pendle

Similar yet very different, but their might be some strategy u can stack on both of them i might share late

❓What is Medium Rare 🧑🍳🥩🤌 u might ask

We are group of internet friends that came together to learn n share insights n stayed for the memes

Want to join Medium Rare 🧑🍳🥩🤌 ...?

Sorry we closed group now

But...

Send me your crypto investing insight, thesis or story if u want to be part of this group

We also welcome funny, smart or hardworking guys to be in the group!

if u read till here,

heres a funny joke for u