Use v3 LP at its best character + 3 Tools

i got some crazy funny git thumbnail, at least hv a look at it

Taking FULL advantage of uniswap V3

How to use v3 at it's best character

+

3 useful V3 LP tools

As mention previously

v3 allows u to choose ur price range.

Concentrating ur money to earn more yield. ( increase capital efficiency)

Read this if u haven't 🔽

https://twitter.com/2lambro/status/1670974245726478338

Hey what if u are not a god tier trader that has a target price range?

How about providing for asset that are suppose to be pegged with each other?

For example

ETH/stETH

USDC/USDT

Probably not a new concept to a lot of guys, but bare with me

i will break down

🎯Risk

🎯metrics to find a good pool

🎯how to check likelyness of depeg

🎯4 tools i use to V3

so Stay with me

📍So why is providing to "pegged assets" a good idea?

U "know" how the asset will perform

U can put all ur LP money at work within that range to work.

E.g.

wstETH/ETH

knowing the price is pegged u can keep the ur range extremely tight

This is can be a tool for u to generate yield if the asset does not yield anything.

imagine if there is pair for wbtc/btc.

u can hv the exposure of holding 1 btc yield earning some trading fee.

📍What is the Downside of this?

🔹Competitive

u are not the only one doing this.

Is there enough trading fee for everyone?

If the asset is truly pegged n risk free, people will offer lower trading fee with even tighter range

small fee /= bad pool

Good metric to find good pools is

Trading fee to TVL ratio 😉

🔹U might be high on hopium in the asset being pegged

After UST, USDT, USDC fuds or wtever

u fear what u dont know

is the yield worth the risk in ur opinion?

u decide

but over all u need to understand is the asset really pegged.

$plsARB is NOT suppose to be pegged with ARB 0.00%↑

but some of my readers didn't realise n got rekt when it first came out

always ask, does the yield justify the risk u taking?

🔹How to check "Depeg risk"

Heres a few quick overview tricks

Check how much LP is on what price.

people can pull liquidity, but this can give u a brief overview on how much it will cost to depeg further.

Check curve pool token balance if available

or just ping me lmao

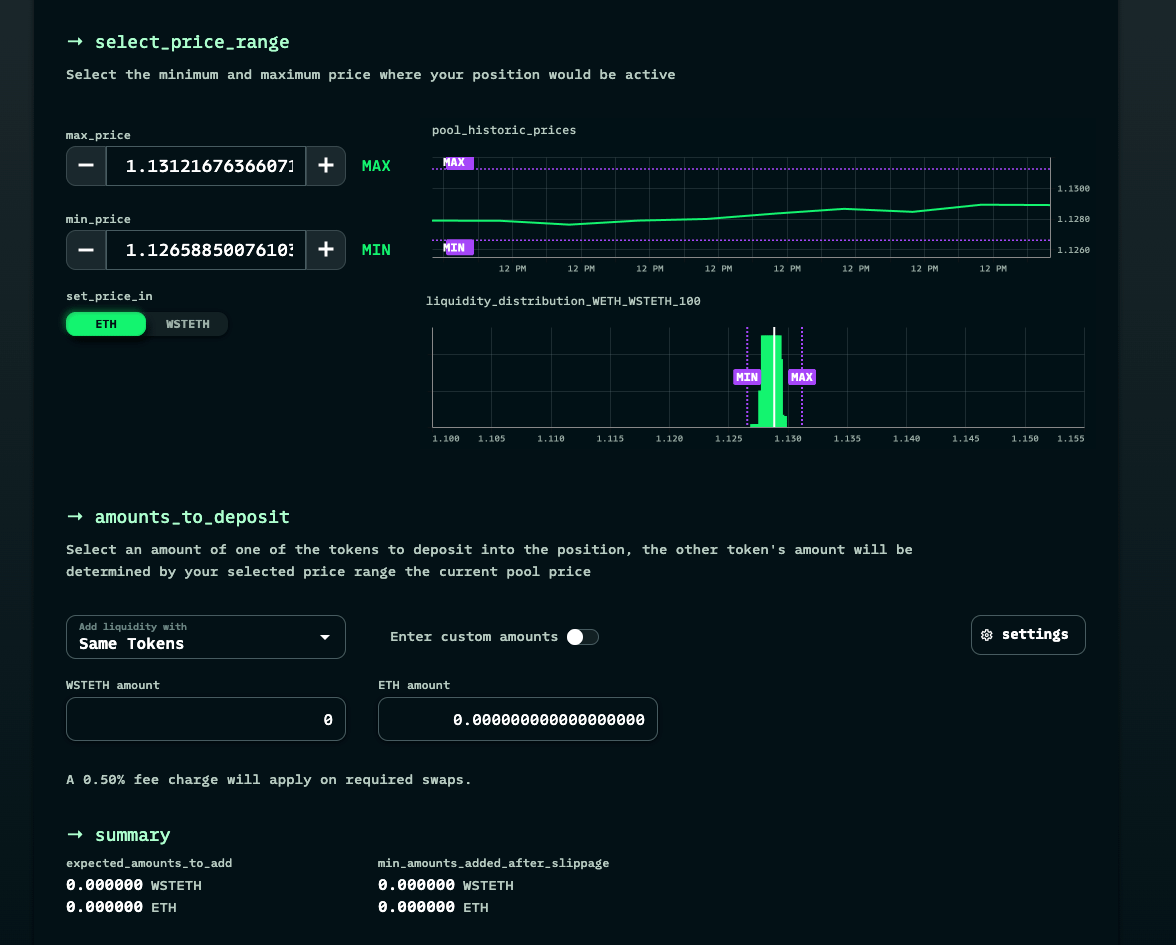

📍 Tools i use uniswap v3

🔹@DefiLab_xyz

Best to compare what range i want to provide LP.

U can input 2 different strategy with different price range and check

fees from history

tokens require to form the LP

where the liquidity of the pairs are

Compare with price chart

yield comparing 2 of ur strategies

Love it but

Sometimes it doesnt load properly tho

🔹 @uniswapdotfish

it has similar features but less graphs which is easier for some users.

i don't know why but i often find myself just putting my range here to check the MIN, MAX and AVG one more time before placing LP

It also has a good tool that u can use to discover some pools where i go on it time to time

🔹@revertfinance

is also a good too.

the user flow is quite good

Choose ur chain > choose ur pair > quick stats about differe fee tier

Follow by price chart n liquidity

Follow by how token swap to LP (with cost)

comparing back test

It makes ur life easy, (who say DeFi UIUX has to be bad?)

📍In summary

Uniswap V3 is a good tool to provide LP for pairs that are pegged.

Find good pools by Fee to TVL ratio

think about risk n reward for depeg

check liquidity for depeg risk

3 tools for u

-follow me so i get to 10k soon hitting my target of 10k in 6 months

Hope u enjoyed this one.

trying to do more fundamental threads, sorry if its too simple!

More V3 LP strategies thread coming.

breaking down this topic for u guys!

Want to track what m i doing?

@DeBankDeFi me baby

First time checking DefiLab, that current price chart with the LP overlay is pretty sweet!

Great stuff Lambroo! How did this one sneak by me in timeline!! Thanks bro