Welcome to our

6 newly lambro substack & 984 substack frens now

134 new twitter followers, join the 13.555k 2lambro Twitter frens

427 frens in “Medium Rare 🧑🍳🥩🤌” Telegram group chat members !

We are still early, learning, growing with u guys since january 2023

Vitalik Buterin as founding advisor

Raised 52m in 2017 and still delivering till today

Kyber is one of the oldest DEX that has been delivering non stop.

I was able to invite @imranfaststart for an interview on

▶️Journey of Kyber from 0 to now

▶️How to handle smart contract risk

▶️Building TVL & Trading Vol

▶️$CRV impact in DEX space & the future

🔥 Alpha for u

1️⃣ Short introduction

My name is Imran Mohamad, Head of Marketing for @kyber Network.

KyberSwap is our decentralized exchange aggregator and all-in-one decentralized finance platform, operating on 14 chains. We are strong advocates of decentralization

I myself was drawn into crypto and blockchain because I believe they can create a fairer, more efficient, and trustless system that provides equitable access and autonomy to everyone, thereby upholding human freedoms.

To make this vision a reality, we need open public blockchains and the building blocks of Finance, which is precisely what DeFi protocols like KyberSwap are building.

2️⃣ The journey of Kyber

Dr. Loi Luu and Victor Tran founded Kyber Network in 2017. They began working on it around 2016 when Dr. Luu was doing a PhD in blockchain technology in Singapore

During his research, he came across blockchain and Ethereum, & his work in this area became one of the most referenced and quoted research within the blockchain and cryptography space till now.

This led them to work on a solution to aggregate liquidity in decentralized finance

The reason behind this decision is if there is low liquidity or no access to liquidity, users won't have a good experience. For instance, they may attempt to make a swap and end up losing 10%, 20%, 50%, or even more of their value on-chain.

To onboard the masses and foster the widespread adoption of decentralized finance, blockchain, and crypto, solving liquidity issues is crucial.

As a result, Kyber Network was launched in 2017, with the support of Vitalik Buterin, the founder of Ethereum, as a founding advisor.

Thanks to this, we successfully raised 52 million USD ICO in 2017.

Kyber Network became one of the pioneering platforms in the early days of DeFi, even before the DeFi summer.

We were among the first to offer on-chain swaps, create liquidity protocols, and function as a DAO for users to participate in governance.

We also played a significant role in industry collaborations, including the initiation of wrapped Bitcoin, enabling users to trade Bitcoin on-chain for the first time ever.

Presently, We have evolved into KyberSwap, a decentralized exchange aggregator and all-in-one tool.

Users can now make swaps at excellent prices, earn on their tokens at excellent rates, and utilize limit orders to buy low and sell high without facing gas fees or slippage.

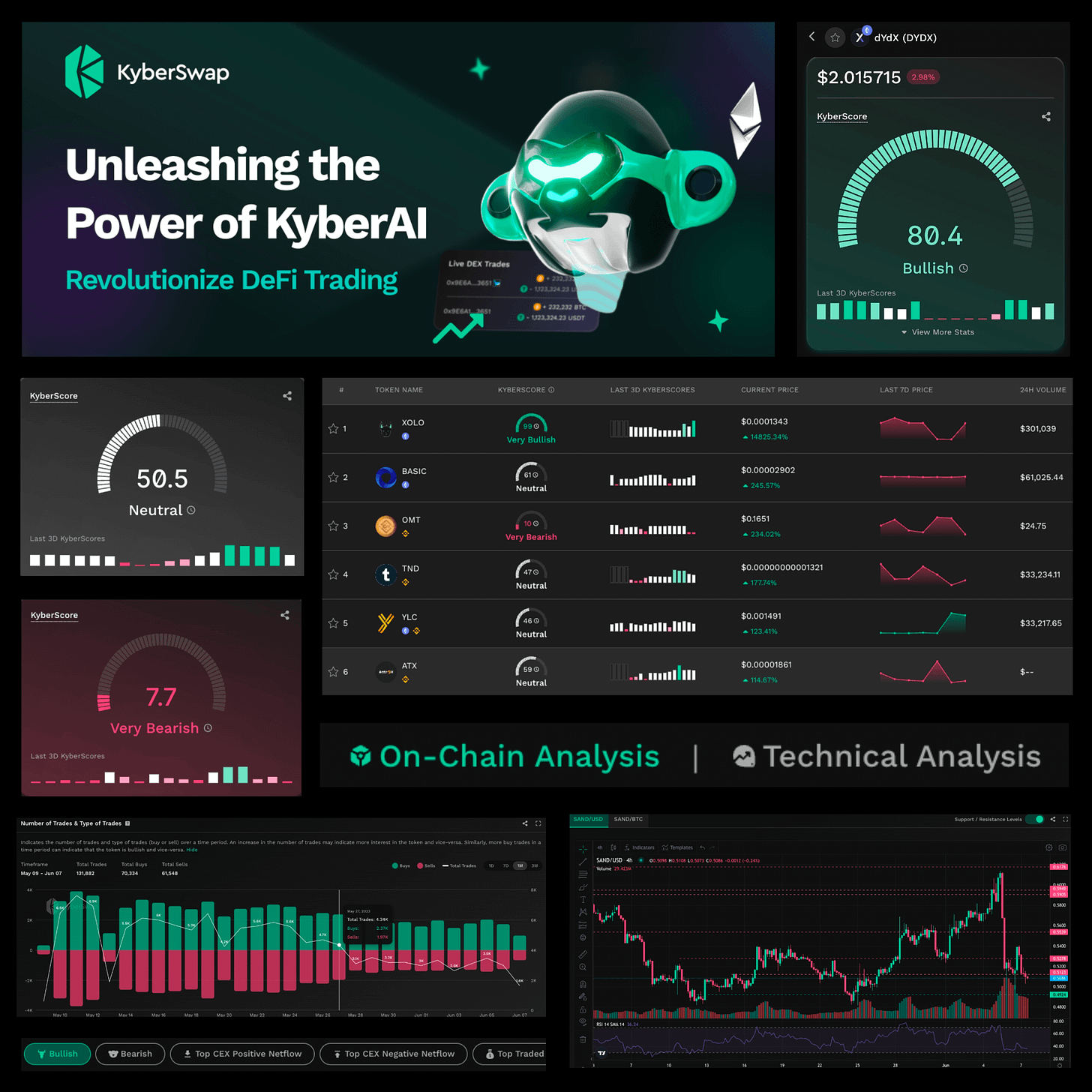

Additionally, Kyber AI, our first-of-kind tool using AI and machine learning, provides real-time bullish and bearish ratings for 4,000 tokens in decentralized finance.

Currently in its free beta stage, this tool is geared towards being the most functional and user-friendly all-in-one decentralized exchange and DeFi platform, with the vision of onboarding many users into decentralized finance and becoming the world's most used DeFi platform.

3️⃣ Smart contract risk has always been the biggest problem of DeFi

with your experience, what is the best way to prevent it, handle it if it happens or recover from it?

There is no easy way to avoid smart contract risks. First and foremost, all smart contracts are created by developers or smart contract engineers.

Therefore, it's essential to have a competent team, not just technically proficient but also capable of understanding the end goal and building with high standards, aligned values towards usability, safety, security, and scalability.

At Kyber Network, we are fortunate to have a great team of developers, quality assurance researchers, and product experts. We dedicate significant time and care to ensure that we build from the ground up with quality code.

We subject our protocols, like KyberSwap Elastic, to smart contract audits, performed by independent auditors like ChainSecurity. Additionally, we regularly update these audits to keep up with the latest security standards.

Working closely with stakeholders, including partners, users, and community developers, is vital in ensuring that the smart contracts function as intended and have no vulnerabilities.

We actively encourage users to report vulnerabilities to us, and we have recently launched a public bug bounty program to incentivize such reporting.

By combining a talented team, stringent processes, smart contract audits, and stakeholder involvement,

we aim to create a strong foundation for mitigating smart contract risks.

In the unfortunate event of an issue or vulnerability, swift and decisive action is crucial to minimize or eliminate any potential damage.

We take such matters very seriously and have demonstrated this in the past. For instance, when we identified an issue with the KyberSwap Elastic protocol, we promptly informed users to remove their liquidity, which amounted to a total value of 108 million.

Thankfully, no one lost their funds, and we quickly improved and fixed the code. Within two months, we relaunched the protocol, and today we have recovered approximately 45% of its initial value.

This proactive approach to transparency and swift action sets us apart, as most protocols struggle to recover from such incidents.

To further reinforce our commitment to safety, our DAO allocates a portion of the treasury as a security fund to cover bug bounties & any potential compensation or reimbursement in case of incidents.

This ensures that we are financially prepared to address unforeseen challenges.

In conclusion, our multi-step approach to smart contract risk management starts from the beginning, extends through regular audits and active engagement with stakeholders, and continues even after incidents to maintain trust and reputation.

We believe that this approach not only safeguards our users but also builds a long-term legacy of ethical and trustworthy practices at Kyber Network.

4️⃣ Different strategies your team is taking to rebuild trading vol & TVL of Kyber

Yes, of course. I think, if you consider our current position, KyberSwap is probably sitting at around 60 million TVL in total.

DeFi has grown significantly since 2018, and at some point, we were the number one DEX around.

However, during the DeFi summer, there was an influx of many new protocols. Eventually, Uniswap became the number one DEX in terms of TVL. Like many other protocols, everyone is trying to figure out how to build up trading volume and the total value locked of the protocol.

It’s essential to think of it as a flywheel, where users bring liquidity, swap tokens, earn from the protocol, talk about the protocol then refer to other users. This cyclical nature needs to continue.

I believe much of our success revolves around how we can bootstrap this flywheel. So, what are the ways to achieve this? Do we simply throw incentives?

If you look at many of the DeFi platforms, a lot of the usage is heavily reliant on new token hype, inflationary economics, and infinite emission schedules. However, we don't have any of that.

We've been in space for more than 6 years now, and any new token hype died a few years after our founding. Additionally, we have a fixed supply, so we cannot infinitely mint our token. DOLL serves specific purposes and must be used pragmatically

Due to these limitations, we need to take a very pragmatic approach to building this flywheel. We want to focus on creating sticky products that perform well and differentiate ourselves from the competition. Our starting point should be figuring out how to differentiate KyberSwap

One of the things that set us apart is our marketing efforts. We work hard to partner with projects in the space and actively promote the DeFi ecosystem.

We engage in various liquidity mining campaigns, trading campaigns, on-chain quests, AMAs, learn and earn activities, blog posts, video walkthroughs, and collaborations with influencers.

Not many decentralized exchanges do this, and our ecosystem strategy is vital for us to become embedded in space.

We also have our liquidity protocol aggregated into many other DApps and aggregators, which increases our trading volume and provides exposure to the KyberSwap brand.

Our highly efficient aggregator is integrated into many decentralized applications, trading platforms, gameFi platforms, and DeFi wallets. This expands our ecosystem footprint and, most importantly, increases the volume that goes through the swap pools.

As of today, we are considered a Challenger in the market when it comes to decentralized exchanges and aggregators. In terms of 24-hour earnings, we are still within the top 10 protocols, excluding L1 and L2 networks.

Across various L2 networks like Polygon, Arbitrum, Optimism, and Celo, we typically rank anywhere from the top three to the top five in terms of 24-hour trading volume and TVL.

This success is also due to our efficient technology, which includes our efficient aggregator and liquidity protocol.

To further support this flywheel, we offer incentives for liquidity providers. They not only earn trading fees but also farming rewards on many chains and pools.

This provides users with increased yields, making them more inclined to become KyberSwap liquidity providers. Additionally, we offer other incentives such as trading campaigns, on-chain quests, and limited edition NFTs that recognize and reward users for their participation.

Ultimately, our goal is to be top of mind when people think of decentralized exchanges and DeFi platforms.

We strive to be present in as many places as possible, whether it's major conferences, AMAs, interviews, co-marketing with creators and media platforms, and providing content on all major platforms for crypto news and updates.

5️⃣ What impact do you think the CRV incident will have on the DEX space?

The CRV incident is suddenly something that should shake the foundations of DeFi.

Many protocols and projects have liquidity or some link to Curve, directly or indirectly.

Curve, which I think is currently sitting at number 11 in TVL, was probably around number five or six before this incident.

Going through this recent incident will certainly shake people’s confidence in decentralized finance.

That’s why it’s essential for DeFi teams and builders to work together and find ways to strengthen each other and the industry. As the saying goes, “we are so early, everyone is a friend”, and I believe that needs to hold true for all builders.

Even when Kyber Network went through its own issues, we had to talk to and rely on the help of many other partners, including central exchanges, other decentralized finance players, crypto forensic agencies, and many other parties to get to the bottom of every issue.

Therefore, it's crucial for us to collaborate on this front moving forward.

I think this incident brings back the prominence of the idea that, first, we need to have better design, better risk assessment, and better checks in place to build DeFi and have a really robust and constant obsession with improvement and plugging any gaps possible.

Being an incumbent or a leader & not looking at those gaps to improve would suddenly be a mistake for any protocol in that position. So, it serves as a good reminder that we must always be vigilant as builders, look into all possible risks, and continuously strive for improvement

Moreover, it's essential to welcome and act on feedback and reports from partners, community members, white-hat developers, and so on.

6️⃣ What do you think about the future of the DEX space?

This is a great question. I’m of the opinion that many decentralized exchanges are all trying to build a better wheel. By “better wheel”.

I mean that traditionally, you would think of a decentralized exchange as a place where you can add liquidity and swap from the pools.

And by large, you will find that these exchanges are trying to compete purely based on how efficiently their AMM or order book systems work.

However, when we think about a decentralized exchange, we view it from the perspective of a user. As a user, am I specifically looking for a decentralized exchange, or do I just want a platform where I can do everything I need to do?

That's our approach. Users want a place that is easy to use, has all the features they need, and goes beyond what you typically expect from a decentralized exchange or aggregator.

The first thing you'll notice about what we're trying to build is a user-friendly, seamless, and fast exchange that covers the use cases and chains that users need.

We operate on 14 chains, offer cross-chain swaps, and enable bridging of USDC with the cheapest and probably fastest method in DeFi right now.

Users can swap with low slippage and high capital efficiency on our pools and use our aggregator.

We've also introduced limit orders, they can buy low and sell high, giving users the ability to set prices and enjoy gasless, slippage-free swaps at their convenience.

We continue to build more use cases, IP, and technology around what people typically expect from a decentralized exchange and aggregator.

Another thing we see as adding even more value is the fact that decentralized finance can be complicated.

For normal users, unless they are experts with years of experience in DeFi, it can be overwhelming to navigate through thousands of tokens.

To address this, we created KyberAI, which is a tool currently in beta stage and free to sign up.

It empowers any user in crypto with the power of AI to sift through all the information in DeFi and make better, faster decisions.

Kaiba AI analyzes more than 21 billion of lifetime volume, using a machine learning algorithm to consider on-chain and technical signals that influence token prices in the future, determining around 4.000 tokens will move up or down (bullish or bearish).

As far as I know, there isn't any other tool in crypto that provides this level of advantage. For pro traders, it can serve as an additional filter to enhance their trading decisions.

7️⃣ Any alpha for the community?

The alpha for the community is always to use KyberSwap for your DeFi needs and trading needs. Of course, our users who used Kyber’s products on Arbitrum received an allocation of the Arbitrum token at the drop.

So, if anyone in your audience is looking for possible airdrops for altcoins, we are deployed now on L2 chains like Arbitrum and very likely on the roadmap soon for Polygon ZK EVM and Optimism. So, there’s more than enough activity there for airdrop hunters.

You can also find a lot of liquidity mining rewards through our farms, as well as on-chain quests and trading campaigns for those who like to participate in and collect rewards, including limited edition NFTs.

My advice is that you will always be happy holding a KyberSwap NFT because we will ensure that you’ll get rewarded.

Beyond using KyberSwap to swap at excellent rates and earn good rates, there are many such incentives directly from Kyber - some from our partners, and some through the airdrops and rewards that we get from the Layer 1 and Layer 2 chains.

8️⃣ What do you think is required to make it in crypto?

We like to joke that being in crypto is like a roller coaster, so you've got to really have a steady heart. This means that you probably have to find a source of stability in order to run the race.

It may feel like a race every day, but really it's a marathon, and you can't run a marathon if your heart rate is going at 140 or 150 beats per minute – you will burn out.

So, I think it's really important to have that stability and not make irrational or emotional decisions in crypto. Patience is a virtue.

However, there are many ways to make it in crypto. Obviously, some people like to trade, some like to hold, some like to farm, and some like to employ multiple strategies at the same time. It really depends on your objective and risk tolerance.

Therefore, it's really important to know yourself before you copy-paste any strategies or tactics that you might have heard on crypto Twitter. Surrounding yourself with the right influences, whether it's the right accounts, media, founders, or friends, is also important to create a support group. This way, if you veer off the edge, you will be brought back towards the right path.

I believe all of these factors are important because there are certainly many life-changing opportunities in crypto.

But what you don't want to do is make a big mistake due to impulsiveness and end up losing everything. It's important to move forward step by step.

Not everyone may agree with me, but one thing that has really skyrocketed my understanding and knowledge of the whole industry is being in space almost 24/7.

I'm not just an investor in the industry; I also work in the industry and talk to many participants, whether they are traders, creators, or project team members, etc.

So, I consider it being paid to gain superior alpha and acquire a lot of knowledge and learning from experts in the industry. This has tremendously helped my personal journey as well.

Thanks for Imran’s time again guys if u have any questions for him feel free to join into my chat group n ask him urself!