Wake up Bro u should farm ETH/USD

A framework on how to measure a good farm, holding vs LPing

If you hold ETH n USDC

You SHOULD farm ETH/USDC v2 LP

if the apy is 20% +

IL is a over rated fud for token holders

Here's a frame work with numbers to show how to find "risk & reward" acceptable apy for token holders

You should stop reading if you do not hold ETH or USD already

This thread's framework is has assumption based on

You are holding ETH already

You don't mind buying a bit more ETH for long term if price drop a bit

Obviously if u smart, this thinking model applies to any token

Here we go

Lambro has 1 ETH & 1800 USD

total networth of 3600 usd

he will not to sell ETH because he loves hodl

Should he put 1 ETH & 1800 USD in uniswap v2 LP for 20% apr ?

Case 1

ETH goes to 3600 usd in one year

the LP will be worth 5091

where if he just hold is 5400 (1 eth =3600 +1800 usd)

The difference ( IL ) is -5.72%

but ur yield of 20% will cover this -5.72% 🤯

Case 2

ETH goes to 900 usd in one year

LP will be worth 2545

where if he just hold is 2700

The difference ( IL ) is -5.72%

but ur yield of 20% will cover this -5.72%

but lambro's networth still went down from 3600worth into 2545 ??

and looking for a job in McDonld now?

Here's the key assumption

HE WAS GONNA HOLD THE ETH ANYWAYS

ETH went down in price, he got rekt not because of LP, IL or all those scary words people don't truly understand

The "action" of LP did not cause you to lose money, ETH's price movement did.

Let me introduce the framework of farming for token that you are holding anyways.

Assumptions

u don't mind holding this token, this is hodl or LP

u have a brief idea of what the price movement e.g. +/- 50%

Formula

if yield - IL = +ve within timeframe

this is profitable

Example

ETH price is 1,880 usd

I think it wont go up or down more than 20% in a week

If it does move IL will be -0.41%

if weekly apr is > IL then its profitable farm

0.41% * 52 = 21.32%

So if any farm is higher than 21.32% it is a profitable farm

Same case with but with 10% price change

IL is only 0.11%

0.11%*52 = 5.72%

meaning if u think price wont move more than 10% 5.72% apy is already a profitable farm

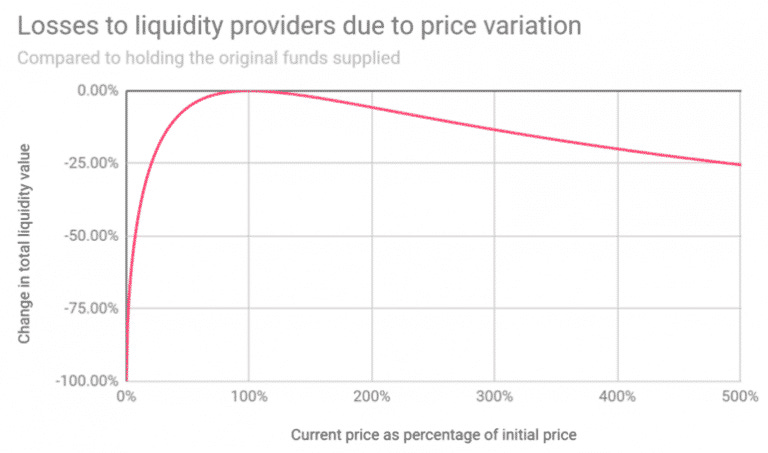

Do note that the curve of IL is not linear the easiest is to just enter in this IL calculators to check.

Obviously there are a lot of moving parts in the decision

e.g

Actual APY after exit, ( farm token price can move a lot )

gas fee

Protocol rug risk

Different farming "time frame" will have different expectation of yield

Some general questions i often ask myself

will the farm token pump n dump?

are there enough liquidity for u to dump the farm token?

are they lock ups or vesting involve?

is gas a considerating factor? ( specially moving funds to L2 )

potential airdrop?

rug ?

gas ?

Some example eth/usd yield

@CamelotDEX 20% apy on arb weth/usdc

@SushiSwap yield 10.19% on arb weth/usdc

@SushiSwap yield 20% on arb weth/usdt

More on zksyn from my old post (apy might not be updated)

Summary

Understanding exposure n comparing decision is key to be a good investor.

As u can see there is a big difference in views on doing LP if u are

purely holding USD

purely holding ETH

hodl ETH n have USD

have a view in price volatility

Understand ur trading tools set best fit ur situation & views towards the market instead of just blindly believe "key words" that kol throw at u.

IL is bad, No IL, AI metaverse tech to aviod IL etc

Now thats a wrap.

hope u enjoyed it.

i need to hit 10k before end of June, show my twitter some love.

Also follow me on debank for my token or farming info!

https://debank.com/profile/0x3af0e0cb6e87d67c2708debb77ae3f8acd7493b5

This thread was heavily inspired by @yieldinator

a true farmer that i respect n convinced to start writing more!

please give him a follow!

Thanks guys!