🤔What if u can Loop leverage on LSDfi n get more yield...?

scrolling thru new protocols n i found something early n maybe interesting

Lending has always been the best tool to leverage or short an asset.

@senecaUSD is a isolated lending market for LSDs to mint senUSD

imagine loop leveraging on LSDfi yield or simply enabling more strategies on top of ur LSD?

❓Can list any tokens to lend + current hot narrative?

LSDfi LP token as collateral?

crvUSD as collateral?

What yield farming magic that would enable?

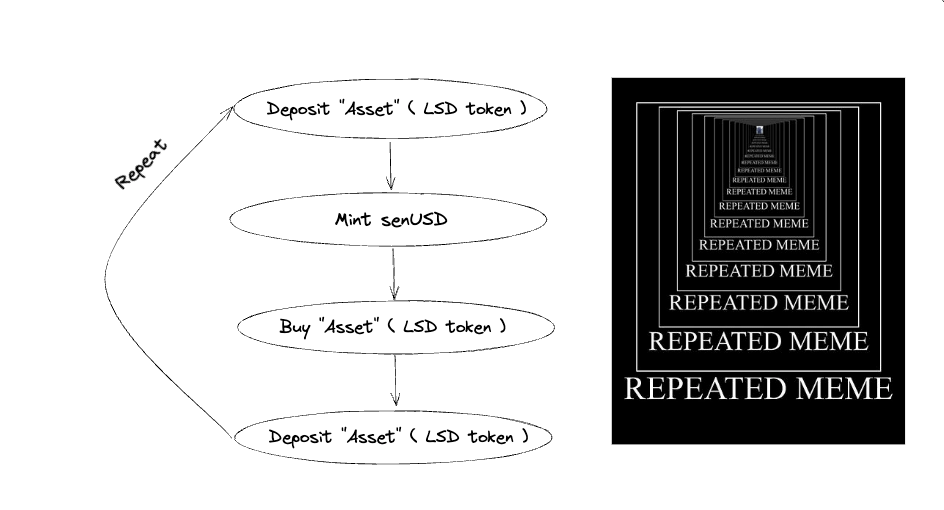

📍How does it work

deposit "Asset", mint senUSD and u can do various strategies on it!

so... what are there strategies?

Strategies u can run

📍 Leverage Long

📍 Run farming strategies on idle capital that was supposed to be locked in ur LSD

**These are strategies is still in theory, need to wait for dapp to launch to double confirm!

📍Levearge Long

Deposit ETH/stETH LP to mint senUSD

Buy more ETH & stETH to LP

Repeat 1

Depening on the max LTV can be given to the "asset".

U can repeat 3 until ur desire leverage.

Things to note

Cost to mint senUSD, make sure the yield>interest rate

Make sure ur LTV is healthy so u won't get liquidated if ETH prices drops

Take into account for slipperage

📍Run farming strategies on idle asset

Deposit ETH/stETH LP to mint senUSD

Run stablecoin yield farm strategies such as senUSD/USDC or swap senUSD into USDC/USDT

This way u aren't having extra exposure in the delta assuming senUSD will mantain the peg

Each lending vault is call Apricus Chambers

They are independent of each other, seperating each pools LTV, interest rate & risk.

This allows more room to list

more exotic collaterals

more different LSDfi tokens

more strategies

👀 Opportunities

Its still very early, but im keeping my eyes on them for now.

Token valuation wise might be too early to check since we don't know when n how they are launching

but

These protocol typically have early farming incentives to boostrap their TVL 👀

$SEN Utility

Real yield revenue distribution (between $veSEN & $SEN)

Bribes

Governance Proposals

Seneca's revenue are

Borrow fees

Interest accrued by open positions

Protocol share of liquidation fees.

Valuation should be in relation of TVL / Fee

Seneca is still in early stage.

seeing a lot more guys talking about to compare to when i first drafted this a week ago.

my strategey is

check out

early farm incentives

potential "airdrop" on actually using the app

depending on their launch date revisit valuation n TGE strategy on market status

keep updated on what asset they are listing there

Thanks guys!

YO WHAT IF I TOLD U CAN FOLLOW WHAT I DO ON-CHAIN

YO WHAT IF I TOLD U CAN FOLLOW WHAT I DO ON-CHAIN