WHO IS BUYING Nitrocartel ON Camelotdex?

Know who u r investing with or against!

📍In the post you will know

🔹How to read our dune board

🔹how & how much is invested in $trove

🔹My thoughts & Speculation

1st collab post with @AwuAle on @DuneAnalytic

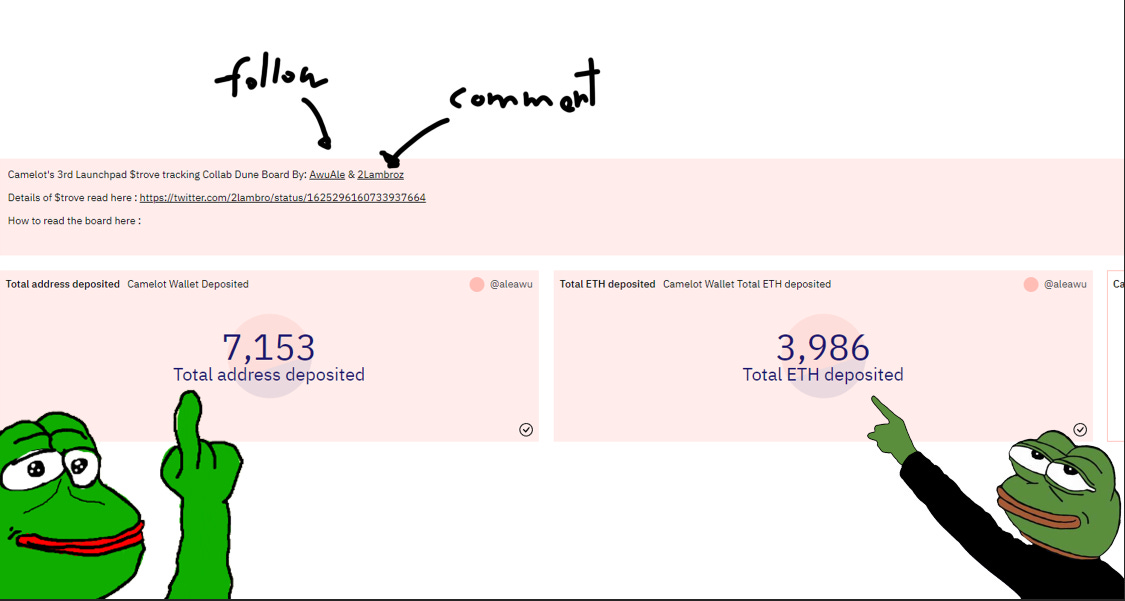

📍Welcome to our dune board

Step1 like and follow my bro @awuale brilliant option trader & dev

Here’s a quick recap n my thoughts on $trove before they were raising

📍Dashboard tutorial

Going into first page of the dash board you can see

🔹Total address deposited = Number of wallet that invested into camelot

As there are no investment cap per wallet i’d imagine its will be mostly 1 wallet 1 user

🔹Total ETH deposit = the amount raise, i will reference camelot’s site for its on-going circ. Marketcap & FDV

https://app.camelot.exchange/launchpad/arbitrove

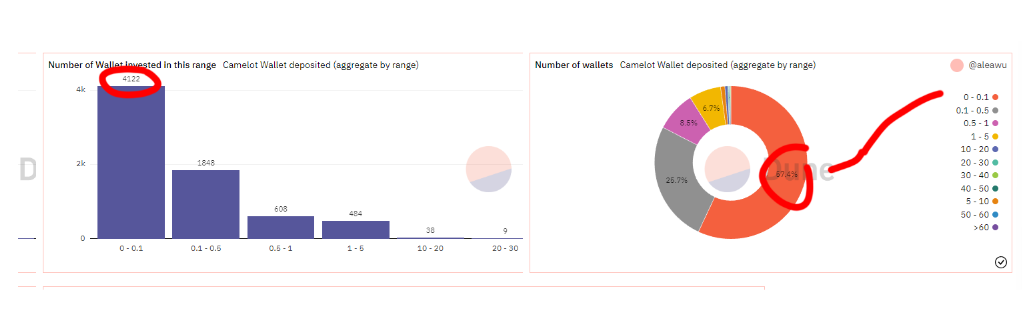

Moving on to the next sector you can see

🔹Total amount of ETH that are invested per wallet size

E.g. there are 1107.5eth raised for wallets that invested 1 - 5eth, being 27% of the total ETH invested

🔹Number of Wallets invested in the range

E.g. There are 4122 wallets that are invested 0-0.1 ETH, being 57.4% of the total number of wallet invested

This gives you a brief idea of what sizes of investors are what % of the total amount investors (who u are trading against)

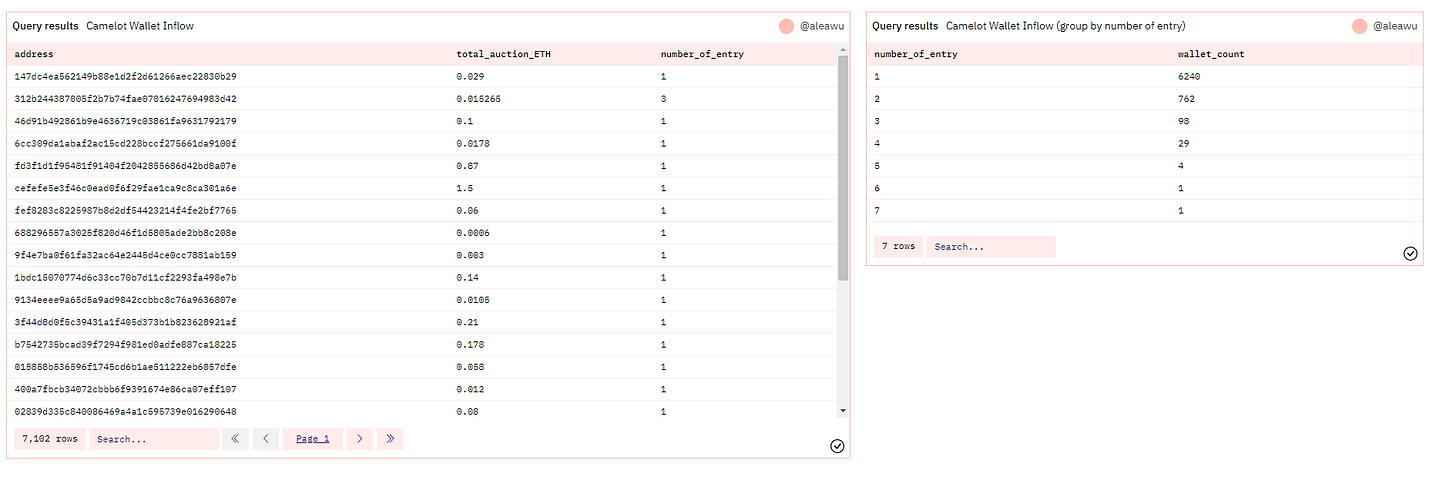

The last sector is mainly to make it easy for you to track different wallets who invested & number of times they deposit.

📍Summary, thoughts & Speculation

Congrats on @nitrocartel’s team on the big raise. I have to say i got dickslapped on my first tweet thinking they might be overpriced, arbitrum proved me wrong lol.

I dug a little deeper on a few wallets that invested a large amount, there are a mix of new wallets and a few arbitrum whale bulls.

The users that took part in this auction are well spread as u can see, a wide range of mini to micro investors with 0-5eth investors contributing over 50% of the eth invested & 83% number of wallets being 0-0.5eth investors.

With these type of auctions most secondary purchase power are exhausted (by design).

However its rare that 100% of these tokens are not vested, personally i think its a dangerous play where it doesnt give time for the team to deliver products/news to support it’s 30m+ valuation.

As mentioned before I have nothing against the team, they have done a good job in BD & marketing and I look forward to using ALP as collateral.

It is just that i worry with most crypto investor’s expectation of moon asap the team will be setup to handle lots of fud with retail users buying at a high valuation and rushing to sell before each other.

Key things i keep an eye on

When and how will the team launch their 60million torve for protocol-own liquidity

with such a larger amount than expected raise? How will they spend it?

even tho the money raise is not for ALP, with that much money raised will they issue more incentive to push TVL of ALP to support $trove price? If so does that meant the might be a chance to buy ALP composition before they do? ( *cap size consider please, highly speculative)

Not gonna lie, I’m happy for the team & arbitrum but really worry if they price dump a lot it will hurt a lot of arbitrum bulls n hurt the momentum of the $grail and camelot.

If you read till here give me a comment to push substack algo and Comment "🐑 " + ur icon if u like!

here is the dune link

Back to the future macfly?

And....it was a scam. Devs just kept selling and dumping and have no product to deliver. Camelot facilitates this rubbish and Arbitrum makes it economical. What a dumpster fire, I won't be getting involved with Camelot again.