wtf is LPDfi, Volatility trading, Impermanent gain?

understand everything about gammaswap in 1 email

LPDfi❗

Volatility trading❗

Impermanent gain❗

What the fk does it actually mean

🤔What can you do with @GammaSwapLabs

How does it actually works

Demystifying the big brain marketing terms into understandable actionable🐏

📍TLDR

Gammaswap allows users to borrow & lend uniswap v2 style LP.

This enables

🔹Trader

borrow LP and leverage trade asset in "Long", "Short", "Straddle" mode.

The trader's pnl on gammaswap is not same as perp (linar) allowing traders to speculate on volatility

🔹Liquidity providers

to earn additional yield from trader's fee on top on their LP position's fee

Gammaswap is essentially a two sided volatility marketplace.

where

traders ( long volatility ) take positions

opposite to

liquidity providers ( short volatility )

Traders can long or short on IL ( which is effect by volatility )

hence the term "trading volatility" and impremanent gain "u can turn the thing upside down" etc

The protocol does not rely on an oracle and is currently built on Uniswap v2 style AMMs.

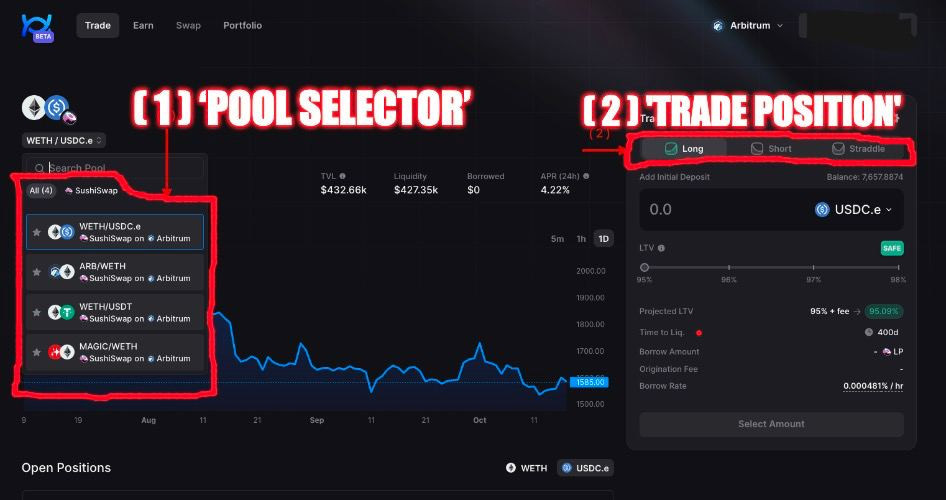

Breaking down into the UI so its easier to explain with images & actions

( 1 ) ‘Pool Selector’:

select the pool you would like to open a position from

( 2 ) ‘Trade Position’:

select Long, Short or Straddle (neutral strategy)

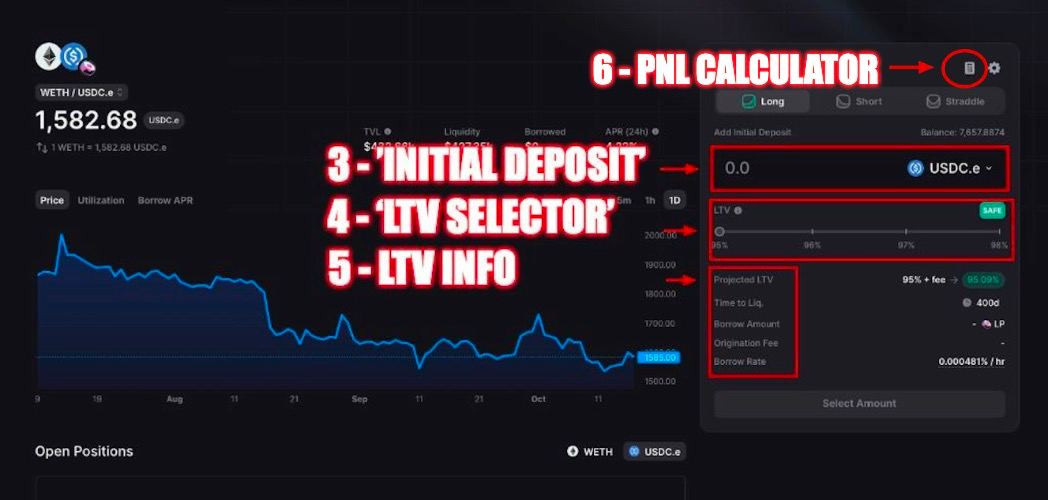

( 3 )- ’Initial Deposit’:

select which token and amount to deposit as your initial collateral

( 4 )- ‘LTV Selector’:

the higher the LTV, the more leveraged your position is and the shorter your ‘Time to Liquidation’ will be

( 5 )- The changes in LTV% will have an effect on

‘Time to Liqudation‘,

‘Borrow Amount

‘Origination Fees’.

( 6 ) PnL Calculator

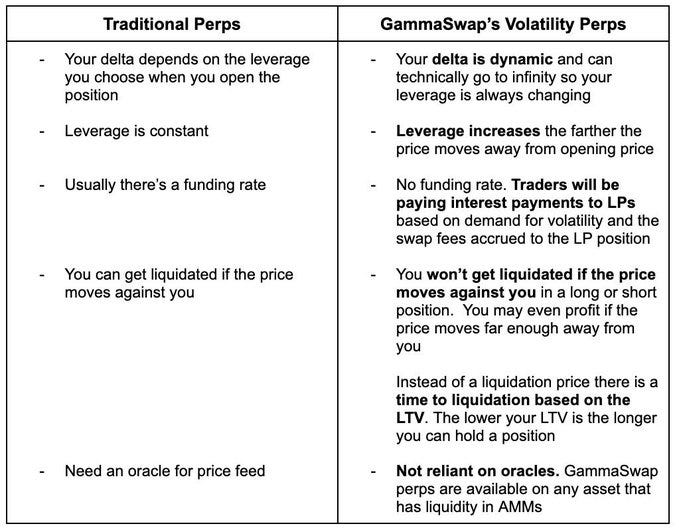

The difference between normal perp & gammaswap's volatility perpetual

GammaSwap is more like a perpetual option although the greeks are slightly different

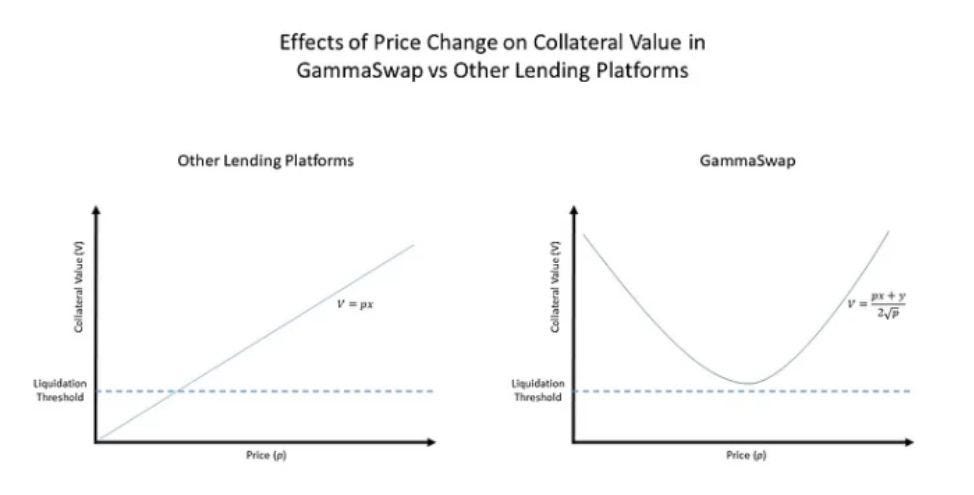

This is the price change effect on collateral value in gammaswap vs other lending platfroms

📍As a trader in Traditional perp

Your PnL = Asset price change x leverage

📍As a trader in Gammaswap

Your PnL = follows the curve below

( the reason in simple form is because your position is basically a borrowed LP

and the number of tokens changes in the LP position changes as the price moves. changing the price correlation toward the asset you long in [Delta] )

This is quite complicated but i think you will start to understand it when you play around the with the PnL calculator

Just to give a better picture

Green line = Long position PnL as price change

Red line = Short position PnL as price change

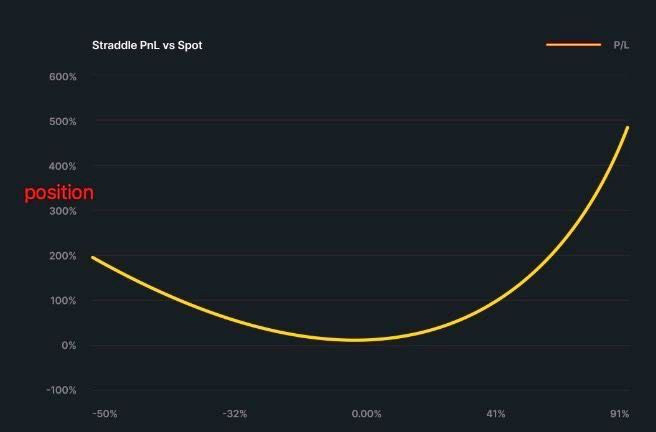

And this is for the straddle position

For people who are not familiar with options

A straddle position is suitable when you want to long volatility but do not have a preference on the price direction

e.g.

DWF has deposit some $MAGIC into CEX but u are not sure will they pump n or dump it. straddle is a way to buy both side if you think the price will move but not sure in which direction/

*please check with the PnL caculator for stimulation

GammaSwap’s straddle is also the best way to hedge an LP position because it is a direct short of the LP position.

GammaSwap is currently a liquidity middle layer for various Uniswap v2 style AMMs.

In addition to swap fees, if the liquidity is borrowed, LPs will earn borrow fees from traders in GammaSwap.

Other than smart contract risk

(which GammaSwap has been audited for),

LP yield in GammaSwap should always be greater than or equal to the underlying AMM.

DeFi will only get more complicated as our industry grow but do it easily with frens along with memes.

If u read till here. u are either very into defi or very bored

i would like to invite u to join medium 🧑🍳🥩🤌